Diving into Recent Market Trends

April often shines like a beacon for Wall Street aficionados, but this year’s April saw a different script unfold. Rising inflation rates, a labor market showing resilience, and a notable drop in U.S. GDP growth have all conspired to shake investors’ faith in riskier ventures such as equities.

Thankfully, the early days of May breathed fresh life into U.S. stock markets. Optimism surged, fueled by new economic data that reignited investors’ passion for equities. A marked downturn in April job creations, a worrisome dip in the U.S. GDP growth rate for the first quarter of 2024, alongside shrinking manufacturing and services PMIs, painted a gloomy picture. However, Federal Reserve Chair Jerome Powell’s less-than-hawkish stance post the May FOMC meet hinted at possible interest rate cuts, reviving market spirits.

Identifying Positive Drivers

Post the unveiling of April’s nonfarm payrolls data, the CME FedWatch tool computes a 67.4% likelihood of a 25 basis points rate cut by the central bank in the September FOMC gathering. Moreover, interest rate futures reveal a whopping 91.5% probability of a 50 basis points rate slash by the Fed.

In addition, the first-quarter 2024 earnings report has brought a breath of fresh air, displaying results better than anticipated. Of the 426 companies on the S&P 500 Index that presented their financials as of May 7, the total earnings of these members soared by 5.2% compared to the same period last year. This uptick was supported by a 4.1% surge in revenues, with 78.2% surpassing EPS estimates and 61% outperforming revenue predictions.

Forecasts now point towards a 4.8% rise in total earnings of the S&P 500 Index in the first quarter of 2024, set against a 4.2% revenue increase. This follows the 6.8% earnings growth on 4% higher revenues in the last quarter of 2023 and a 3.8% earnings climb on 2.2% higher revenues in the penultimate quarter of 2023.

Highlighted Investment Selections

Amidst the many options available, we have singled out five stocks set to sparkle in 2024, boasting robust earnings estimate revisions over the past 60 days. Each of these selections carries a Zacks Rank #1 (Strong Buy) and flaunts an A-grade Growth Score.

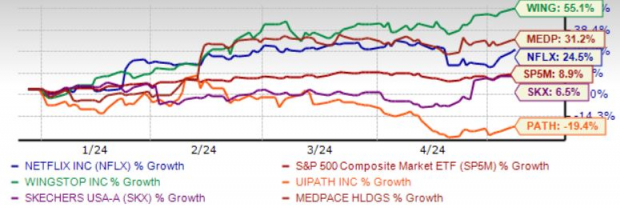

Below, you can observe the year-to-date price performance chart for these five promising choices.

Image Source: Zacks Investment Research

Netflix Inc.

Netflix Inc. persisted in its winning streak, adding 9.33 million paying subscribers globally in the first quarter of 2024. The streaming giant credited this growth to various factors such as paid subscription-sharing initiatives, recent pricing adjustments, and the overall strength of its operations.

The company is set to maintain its dominance in the streaming realm thanks to its diversified content portfolio, driven by substantial investments in localized and foreign-language content production and distribution. Forecasts predict a 14.7% revenue growth and a staggering 52.1% surge in earnings for the current year.

Wingstop Inc.

Wingstop Inc. is taking flight in the food industry with its focus on classic wings, boneless wings, and tenders made to order and sauced to perfection. The company expects revenue and earnings growth rates of 27.5% and 37.1%, respectively, this year.

In the past week alone, the Zacks Consensus Estimate for current-year earnings has soared by 12.2%, painting a promising picture for investors considering this stock.

UiPath Inc.

UiPath Inc. steers the ship in automation solutions through its extensive range of robotic process automation offerings across various markets. With a projected 15.9% revenue growth and 5.6% earnings uptick for the current year ending January 2025, UiPath is on a trajectory of success.

Recent data reveals a substantial 16.3% improvement in the Zacks Consensus Estimate for current-year earnings over the past 60 days, making UiPath a notable contender in the investment arena.

Skechers U.S.A. Inc.

Skechers U.S.A. Inc. is making solid strides in the footwear business by focusing on comfortable options that align with evolving lifestyle preferences. The company’s investments in global infrastructure support both online and offline growth, nurturing better customer interactions and seamless experiences.

Forecasts paint a picture of a 10.3% revenue hike and a 15.2% earnings surge for the current year. The Zacks Consensus Estimate for current-year earnings has impressively risen by 5.2% over the past 30 days, highlighting the positive sentiment surrounding Skechers.

Medpace Holdings Inc.

Medpace Holdings Inc. stands out in the clinical research industry, providing essential services for drug and medical device development across multiple regions. With an expected revenue growth rate of 15% and a solid 26.5% earnings increase for the current year, Medpace Holdings is poised for steady growth.

Investors have taken note of this potential, with the Zacks Consensus Estimate for current-year earnings growing by 6.6% over the past month, underscoring the company’s positive trajectory.