Increased government infrastructure spending is acting as a potent tailwind for companies in the Zacks Building Products – Miscellaneous industry. Despite facing potential headwinds like macroeconomic uncertainties, soaring rates, and escalating raw material costs, firms such as Advanced Drainage Systems, Inc., Armstrong World Industries, Inc., Frontdoor, Inc., Construction Partners, Inc., and Latham Group, Inc. are poised to thrive due to their focus on operational excellence, geographic expansion, product diversification, strategic acquisitions, and increased infrastructure investments.

Industry Overview

The Zacks Building Products – Miscellaneous sector consists of manufacturers, designers, and distributors offering home improvement and building solutions such as ceiling systems, doors, windows, flooring, and metal products. This industry also plays a crucial role in rejuvenating aging infrastructure, with a focus on pipelines in water, energy, and refining sectors. Additionally, companies in this space provide various products ranging from expansion joints and ventilation systems to ground-mounted solar racking and mail storage solutions, catering to a diverse clientele including construction companies, homeowners, and government entities.

Key Trends Shaping the Industry

Influx of Infrastructural Spending: The industry is set to benefit from the global push towards infrastructural modernization, energy transition, and security enhancements. Notably, the U.S. government’s initiatives to revamp national infrastructure, roads, climate-resilient projects, and broadband services are expected to fuel growth. Moreover, upswings in the residential construction market have bolstered builders’ optimism, driving demand for new homes and consequently, industry products.

Focus on Operational Excellence and Expansion: Industry players are ramping up cost-saving efforts through operational streamlining, system enhancements, and workforce optimization to enhance profitability. Moreover, companies are channeling resources into research for new product development, digital solutions, and acquisitions to drive revenue growth and expand their market reach.

Challenges of Rising Costs: Inflationary pressures stemming from transport, material, and energy costs, coupled with escalating labor expenses, pose significant challenges. Despite attempts to mitigate these through price adjustments and supply chain optimizations, sustained cost volatility could impact profit margins, especially amid ongoing uncertainties in material prices.

Striking Industry Rank

The Zacks Building Products – Miscellaneous sector, comprising 27 stocks within the Zacks Construction segment, currently holds a Zacks Industry Rank #57, placing it in the top 23% of Zacks-tracked industries. This favorable industry rank underlines optimistic near-term prospects, with historical data indicating a bullish trend for constituent companies within this sector.

Industry performance metrics reveal a positive trajectory for earnings estimates, with analysts progressively revising upwards industry-wide earnings forecasts, now standing at $4.80 per share for 2024, up from the earlier projection of $4.77 per share in May 2024.

Market Outperformance and Valuation

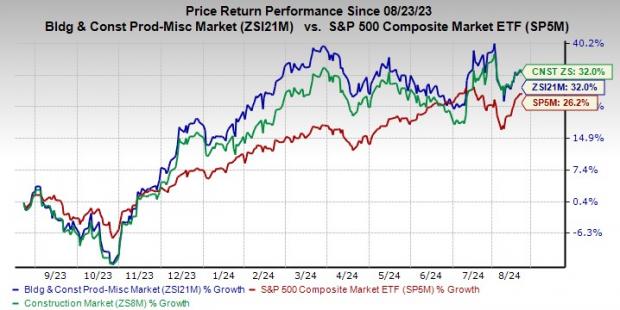

Despite macroeconomic challenges, the Zacks Building Products – Miscellaneous industry has emerged resilient, outperforming the Zacks S&P 500 Composite Index and remaining on par with the broader Construction sector over the past year. Notably, industry stocks have delivered a robust 32% surge, aligning closely with the 26.2% rise seen in the Construction sector, while showcasing superior performance compared to the Zacks S&P 500 Composite’s 26.2% uptick over the same period.

One-Year Price Performance

Valuation Insights

From a valuation standpoint, the industry’s forward 12-month price-to-earnings multiple, a key valuation measure, stands at 16.7X, underscoring favorable valuations when compared to the S&P 500’s 21.6X and the sector’s 17.5X multiples. Over the past five years, the industry’s P/E ratios have ranged from 11.1X to 20.1X, showcasing a median value of 15.9X, as depicted in the chart below.

Industry’s P/E Ratio (Forward 12-Month) Versus S&P 500

Top 5 Building Product Stocks for Consideration

Among the plethora of building product options, we have identified five standout stocks with Zacks Rank #1 (Strong Buy) or 2 (Buy) ratings.

Frontdoor: Headquartered in Memphis, TN, Frontdoor specializes in offering home warranties across the United States. The company’s robust performance is attributed to its strategic focus on innovation and service demand, with the recent revamp of the American Home Shield brand serving as a pivotal element in this growth strategy. Going forward, Frontdoor remains committed to fortifying its market presence through brand and technology investments, aiming to enhance operational efficiencies across the organization.

Frontdoor, designated as a Zacks Rank #1 stock, has exhibited a commendable 49% price surge in the past year. Noteworthy is the 8.3% upward revision in its 2024 earnings estimates over the last 30 days, now standing at $2.73 per share, projecting an impressive 18.7% year-over-year growth for the year. The company’s robust financial performance has not only surpassed but also exceeds market expectations.

Exploring the Resilience of Construction and Infrastructure Stocks

Construction Partners Soars Amidst Infrastructure Demands

In the heart of Dothan, AL, Construction Partners, a civil infrastructure company, is exceeding expectations. With its stronghold in the Southeast, the company is navigating through turbulent waters of labor shortages and inflation challenges, showcasing its prowess in the construction and maintenance of roadways.

Despite the tough climate, the recent acquisition strategy of Construction Partners is akin to a skilled chess player making strategic moves on the board, positioning itself for growth in fast-emerging markets. Such maneuvers have rightfully earned the company a place in investors’ hearts, with a 81.6% gain in its stock over the past year.

Latham Group: Riding the Waves of the Residential Pools Industry

Splash! Latham Group, a prominent figure in the world of residential swimming pools and accessories, is making a colossal splash in Latham, NY. By focusing on fiberglass pools over traditional concrete ones, the company is riding the tide of innovation and cost-efficiency.

Moreover, Latham’s recent acquisition of Coverstar Central, akin to a skilled surfer catching the perfect wave, shows its strategic acumen in enhancing margins and fortifying relationships with pool builders. This astuteness has translated into a 46.6% stock gain in the past year.

Advanced Drainage Systems: Navigating the Waters of Water Management Solutions

In the industrious town of Hilliard, OH, Advanced Drainage Systems is making waves with its innovative water management solutions. Tackling challenges head-on, the company is set to capitalize on increased demand from infrastructure, residential, and agriculture sectors. Their focus on operational efficiency is akin to a ship steered by a seasoned captain through stormy seas, ensuring prosperous voyages ahead.

The earnings consistency of Advanced Drainage Systems is a testament to its robust performance, having surpassed estimates in all the trailing four quarters. This, alongside its 25.4% stock gain in the past year, positions the company as a sturdy ship in the financial waters.

Armstrong World Industries: Reaching New Heights in Ceiling Systems

From the architectural wonderland of Lancaster, PA, Armstrong World Industries stands tall as a global leader in ceiling systems. By focusing on innovation and strategic acquisitions, the company is painting a masterpiece in the commercial, institutional, and residential construction sectors.

Investments in digitalization and new product development are akin to a painter exploring new color palettes to create captivating works of art. With a 67.4% stock gain in the past year and a string of positive earnings surprises, Armstrong World Industries is truly reaching new heights in the realm of construction and renovation.