1. The Crucial Role of Pricing Power

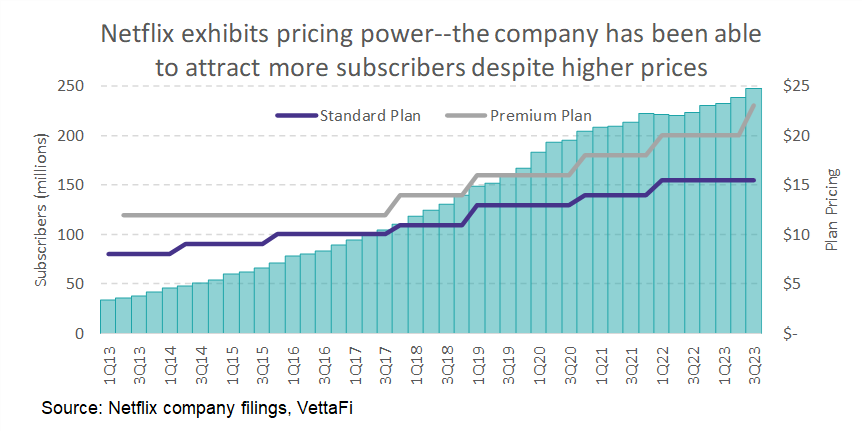

As investors gear up for the year ahead, the spotlight turns to the vital significance of pricing power in navigating near-term fluctuations in demand. While it’s easy to foresee shifts in demand patterns that impact sector revenue growth, the real challenge lies in balancing sustainable revenue growth with market expectations. Analysts, known for their penchant for growth, tend to equate higher revenue growth with elevated stock prices. However, for companies like Netflix (NFLX) and Tesla (TSLA), which already boast a significant market share, sustained growth necessitates price increases. This ability to raise prices while maintaining or even growing demand is what defines pricing power. This strategy not only enables companies to boost revenue amid moderating demand but also empowers them to recover higher inflation-induced costs by passing them on to consumers. The consumer staples and discretionary sectors are poised to showcase stronger pricing power, notably in companies selling irreplaceable goods or brand-name products like Coca-Cola (KO), Costco (COST), Nike (NKE), and LVMH Moet Hennessy. Investors can find opportunities in ETFs such as the Consumer Staples Select Sector SPDR Fund (XLP) and the Tema Luxury ETF (LUX) which capture companies demonstrating robust pricing power. An option such as the Invesco Bloomberg Pricing Power ETF (POWA) presents a way to access firms with strong pricing leverage at large.

2. Navigating Labor Issues from an ETF Perspective

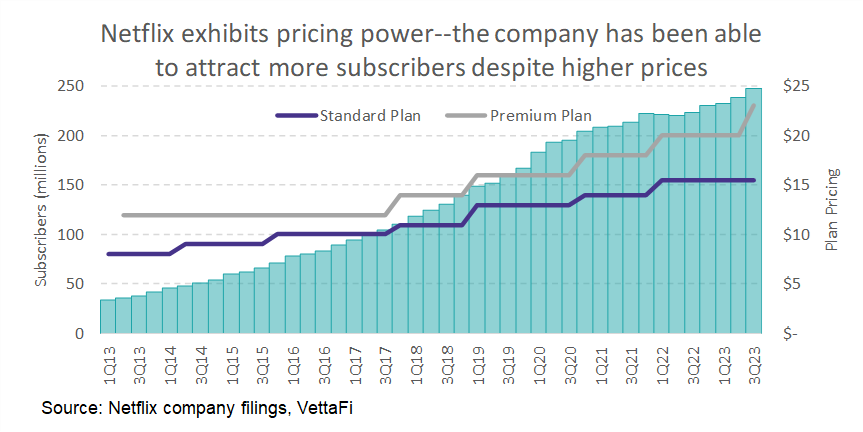

In 2023, labor strikes, notably in the automobile and entertainment industries, underscored the disruptions labor disputes can inflict on earnings. With inflation outpacing wage growth, 2024 is likely to witness continued labor turmoil in unionized sectors such as manufacturing and services. While there could be modest industry-wide repercussions across ETFs, not all companies within these sectors are unionized, and the market may favor non-unionized competitors. For instance, while auto giants like Ford Motor Co (F), General Motors (GM), and Stellantis (STLA) grappled with employee strikes, non-unionized manufacturers such as Honda Motor Co and electric vehicle leader Tesla managed to maintain more stable stock prices. Diversified ETFs like the Global X Autonomous & Electric Vehicles ETF (DRIV) offer a buffer against supply disruptions and wage-driven cost spikes, steering clear of the profit squeeze seen in companies hit by labor disputes.

3. Revisiting Small-Cap Equities for Diversification

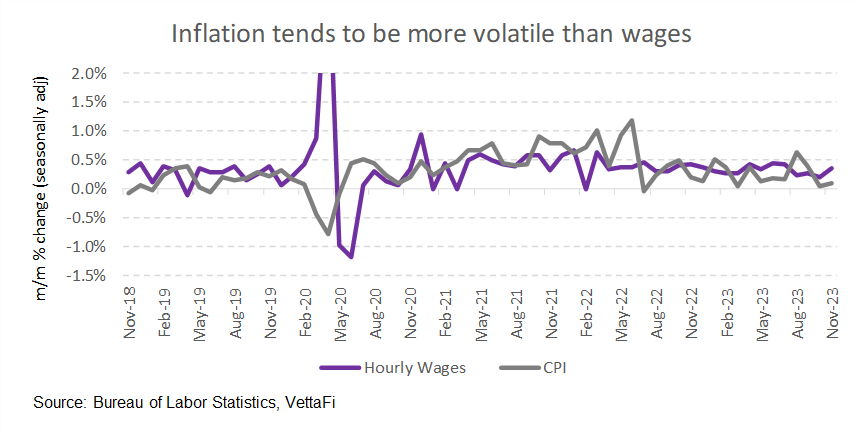

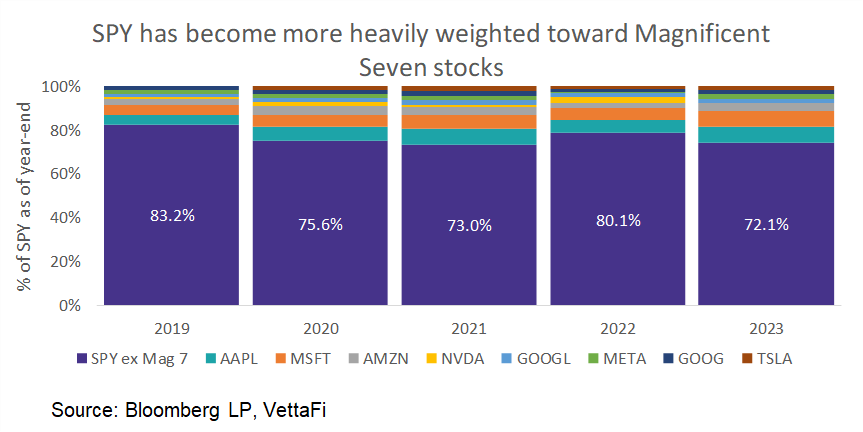

While large-cap stocks are deemed a safer bet for many investors, especially with the outsized performance of the so-called Magnificent Seven stocks driving the S&P 500, the undervalued small-cap segment is witnessing a resurgence. The SPDR Portfolio S&P 600 Small Cap ETF (SPSM) outperformed its larger counterparts, underscoring the potential of small caps to counterbalance the dominance of the Magnificent Seven and curb overexposure to these stocks. While large caps are by no means losing their allure, a prudent review of the allocation to these stalwarts is advised, considering their significant representation in broad domestic equity and technology ETFs, as well as a myriad of thematic ETFs.

4. Unlocking Opportunities Beyond Crypto ETFs

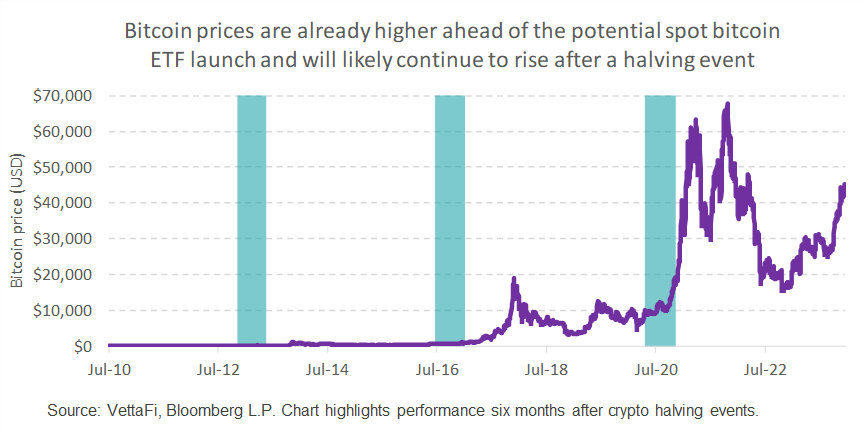

The soaring start of Bitcoin in 2024, coupled with the imminent launch of spot Bitcoin ETFs, sets the stage for a new era of mainstream acceptance and legitimacy for cryptocurrencies. While the potential of spot Bitcoin ETFs to broaden investor access to the crypto market is palpable, this is just one chapter in the evolving crypto story. The momentum is expected to amplify with greater institutional and retail adoption, spurred by the forthcoming halving event which historically catalyzes upward price movements. Equities of crypto-focused ETFs, such as the Valkyrie Bitcoin Miners ETF (WGMI), the VanEck Digital Transformation ETF (DAPP), and the Invesco Alerian Galaxy Crypto Economy ETF (SATO), are poised to rally alongside Bitcoin prices. A broader shift toward embracing crypto presents an avenue for further growth, signaling a maturing cryptocurrency market beyond a fleeting internet enthusiasm.

VettaFi will be hosting its first Cryptocurrency Symposium webcast on January 12, 2024 at 11 a.m. ET. Click here to register.

For more news, information, and strategy, visit the Crypto Channel.