Kudos to Advanced Micro Devices (NASDAQ: AMD) for holding its ground in a fiercely competitive landscape against tech giants like Intel (NASDAQ: INTC) and Nvidia (NASDAQ: NVDA). Staying in the race with such industry heavyweights is no small achievement.

While AMD may not be at the helm of the graphics processing or computer processor sectors, sometimes the underdog emerges as the top investment opportunity. Here’s a closer look at four compelling charts that make a strong case for AMD as a buy.

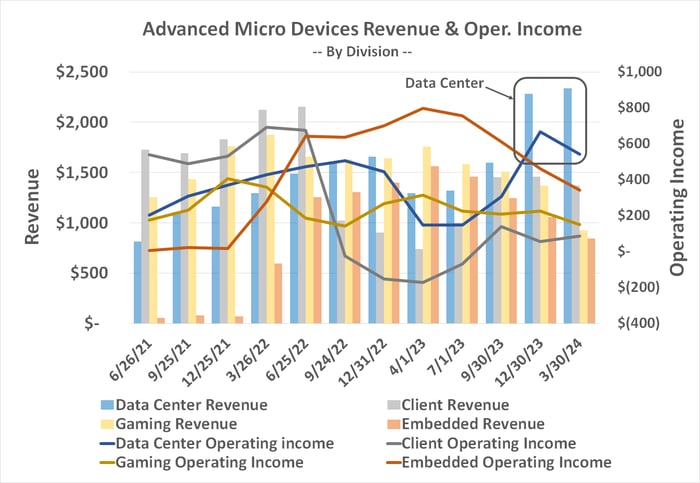

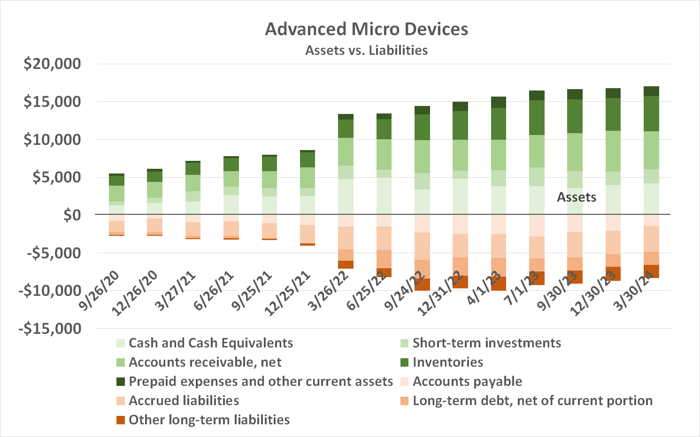

Data Centers Leading the Way

The first chart reveals a fascinating evolution in AMD’s business lines, illustrating how data centers, driven by the surge in artificial intelligence applications, have emerged as the company’s primary revenue and profit generators. This shift positions data centers as AMD’s most lucrative sector, riding the wave of AI’s increasing dominance in the tech landscape.

Data source: Advanced Micro Devices. Chart by author. Figures are in millions.

The burgeoning AI market presents a promising growth trajectory for AMD, aligning with forecasts projecting significant annual growth rates. This trend positions AMD favorably for sustained success in the AI hardware sector.

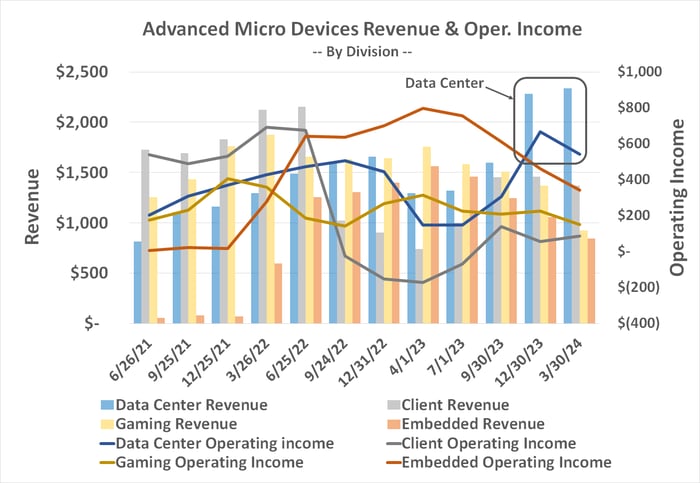

Resurgence in Cash Flow

AMD’s recent foray into the AI hardware market, though initially overshadowed by competitors like Nvidia, is showing signs of promise. Despite significant investments in research and development and the acquisition of Xilinx, AMD’s operational cash flow and net income are rebounding, as depicted in the chart below.

Data source: Advanced Micro Devices. Chart by author. Dollar figures are in millions.

While gross profits may appear static due to competitive pricing in the AI hardware market, AMD’s strategic positioning and anticipated growth in AI technology bode well for future profitability. Analysts predict a significant uptick in per-share profits over the coming years, signaling a robust outlook for the company.

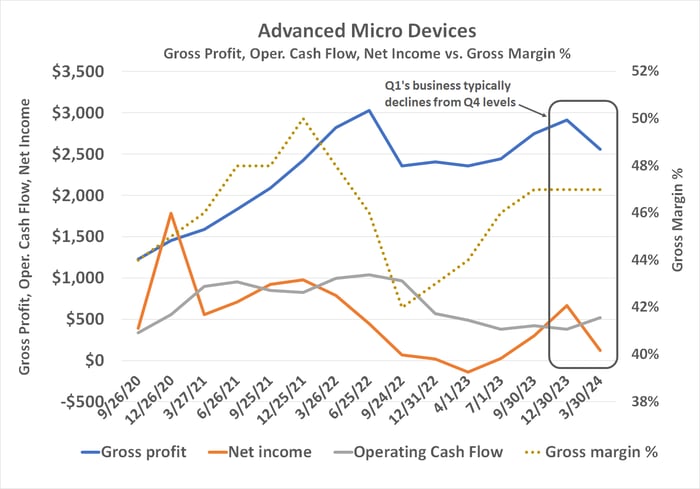

Debt-Free and Financially Robust

Notably, AMD boasts a lean balance sheet with minimal debt obligations compared to its substantial cash reserves. With long-term debt amounting to around $1.7 billion and ample cash reserves exceeding $6 billion, AMD enjoys considerable financial flexibility. Additionally, the company holds significant assets that could be readily converted into cash if needed, underscoring its sound financial standing.

Data source: Advanced Micro Devices. Chart by author. Figures are in millions.

Despite minor liabilities, AMD’s current asset base far outweighs its short-term and long-term obligations, highlighting the company’s sound financial health and sustainable growth prospects. Furthermore, AMD’s proactive debt management and declining overall liabilities underscore its prudent financial management.

Verdict: A Strong Buy Signal for AMD Stock

In a market rife with uncertainties, AMD stands out as a beacon of stability and growth potential. The company’s strategic positioning in high-growth sectors, rebounding profitability, and robust financial profile make a compelling case for investors seeking a promising long-term bet. While risks persist in the volatile tech landscape, AMD’s trajectory as depicted in these charts paints a positive outlook for prospective investors.

Unraveling the Financial Tapestry of Advanced Micro Devices

The battle between Intel and Nvidia to rein in Advanced Micro Devices (AMD) and curb its encroachment into the market landscape has reached a fevered pitch. Each competitor is determined to blunt AMD’s momentum before it conquers more market share.

Despite the strategic maneuvers by Intel and Nvidia, the fiscal trends illustrated in the charts vividly depict a compelling narrative. AMD’s strategic decisions are bearing fruit, positioning the company for sustained success. The trajectory hints at promising growth ahead, a reality that many other companies would envy.

Deciphering the Investment Potential of AMD

Before diving into the world of AMD stocks, it’s crucial to ponder this:

The Motley Fool Stock Advisor analysts have divulged the top 10 best stock picks believed to yield substantial returns for investors. Interestingly, AMD did not make the exclusive list of top-performing stocks projected to yield phenomenal gains.

Recall when Nvidia was featured on this distinguished list back on April 15, 2005? Imagine investing $1,000 during that period based on their recommendation. The result? A staggering $759,759*. It’s a testament to the soaring potential that astute investments can unlock.

The Stock Advisor service doesn’t just stop at providing recommendations. It equips investors with a user-friendly blueprint for success, offering insights on portfolio construction, regular analyst updates, and the unveiling of two new stock recommendations monthly. The service has managed to outperform the S&P 500 by an impressive margin since 2002*.

*Stock Advisor returns as of June 24, 2024