Forget striking gold with a million-dollar lottery ticket; the real ticket to wealth may be hiding in plain sight: undervalued stocks. These hidden gems, with strong potential yet trading below their true worth, offer the tantalizing prospect of owning a piece of the future titan before the crowd catches on.

While the stocks discussed below may not be entirely under the radar, they are on the path to growth. And from a certain perspective, growth equates to hidden potential. At the core of the investment game lies the hunt for undervalued stocks, anticipating a surge in share price and fortunes ahead. The spotlight shines on the technology sector in this article, with a particular focus on artificial intelligence (AI) and electric vehicles (EVs). Let’s delve into these undervalued stocks that could pave the way to millionaire status.

Advanced Micro Devices (AMD)

Advanced Micro Devices (NASDAQ:AMD) stock, against all odds, may be undervalued at present.

By now, the narrative around Advanced Micro Devices is familiar: a dominant player in the flourishing AI chip segment, offering solid value. Positioned as the provider of the second-best AI chips, AMD enjoys a relatively invulnerable stance, shielded from the intense scrutiny faced by Nvidia (NASDAQ:NVDA). However, AMD benefits from the surging influx of investor funds in AI chip stocks, with an external opportunity to potentially rival Nvidia’s supremacy in AI chip manufacturing.

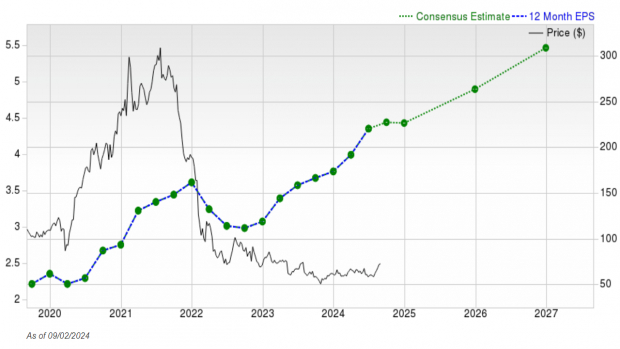

The argument for AMD’s undervaluation boils down to earnings. After a dip in annual earnings in 2022 and 2023, forecasts predict a staggering 500% surge in 2024, propelling growth for the years to come. At $157, AMD’s stock price appears undervalued, contrasting the consensus placing its true value at $195, stretching as high as $265.

BYD (BYDDY)

BYD (OTCMKTS:BYDDY) stock, on its road to profitability and maturation, emerges as an undervalued contender.

Boasting margins exceeding the 20% mark, BYD outshines Tesla (NASDAQ:TSLA) on this front. Furthermore, as the largest global producer of EVs, BYD’s 2023 output of over three million vehicles marked the second consecutive year surpassing Tesla’s production figures.

The healthily high gross margins hint at a robust internal economy within the company, bolstered by substantial sales volumes. This winning combination underscores BYD’s persistent undervaluation, presenting an irresistible opportunity for investors amid the prevailing downtrend for EV stocks.

Snowflake (SNOW)

Snowflake (NASDAQ:SNOW) stock remains buoyed by historical multipliers, reminiscent of those witnessed in 2020. Sporting a low price-to-sales ratio of 14.2, Snowflake seems attractively undervalued compared to the past decade trends.

Despite CEO Frank Slootman’s imminent departure in late February causing a stir, Snowflake’s fundamental prospects have remained intact. Recent earnings reports reveal robust top-line growth at 34% and remarkable revenue retention rates, reflecting the company’s adeptness in serving its customer base.

The exodus of growth investors from Snowflake following the CEO transition might have been sparked by speculative fears. However, the latent potential in Snowflake’s undervalued status beckons to savvy investors attuned to the growth stock upheavals.

Alex Sirois is a freelance contributor to InvestorPlace who harnesses a long-term, buy-and-hold investing approach, drawing on an eclectic professional background spanning industries such as e-commerce, translation, and education, alongside his MBA from George Washington University.

More From InvestorPlace

This article was originally published on InvestorPlace.