Artificial intelligence (AI) has entrenched itself as the belle of the ball in the tech realm, captivating audiences high and low for over a span of 18 months. From the rise of groundbreaking generative AI like ChatGPT, the tech has left an indelible mark on the mainstream.

The financial sphere, smitten by the commercial success of AI tools, has seen a flurry of activity. Numerous tech entities with a toe in the AI waters have witnessed soaring stock prices as eager investors sought to cash in on the booming trend. However, despite this wave of success, there lies an ocean of untapped growth potential waiting to be explored.

For those looking to dive into this thriving sector, there are three prime contenders poised for a bull run:

1. Microsoft

Microsoft has been basking in the limelight, finally overtaking long-time contender Apple to claim the throne as the world’s most valuable public company, sporting a hefty market cap exceeding $3.1 trillion.

A significant player in the AI game, Microsoft solidified its standing through a strategic union with OpenAI, the brains behind ChatGPT. Originally a $1 billion investment back in 2019, the partnership has blossomed into a mutually rewarding relationship.

By leveraging Azure, its cloud powerhouse, Microsoft provides OpenAI with the necessary supercomputing heft to amplify its operations. In return, Microsoft gains exclusive access to OpenAI’s large language models (LLMs).

Utilizing OpenAI’s LLMs has given Microsoft a competitive edge, enabling the integration of intelligent AI components into its existing suite of products and services. With a diverse array of offerings catering to both consumers and corporations, Microsoft stands on the cusp of domination in several industries, armed with AI-driven prowess.

2. CrowdStrike

CrowdStrike emerges as a cybersecurity stalwart, powered by a potent blend of pure AI capabilities. Honing AI for over a decade to automate cybersecurity operations, CrowdStrike differentiates itself from the pack through its coveted asset: data.

With AI tools thirsting for copious data to attain optimal functionality, CrowdStrike holds a golden ticket. Bolstered by copious years-worth of data, CrowdStrike has witnessed staggering success metrics on both the business and financial fronts. A substantial chunk of clients embracing multiple products in its ecosystem underscores the platform’s robust performance.

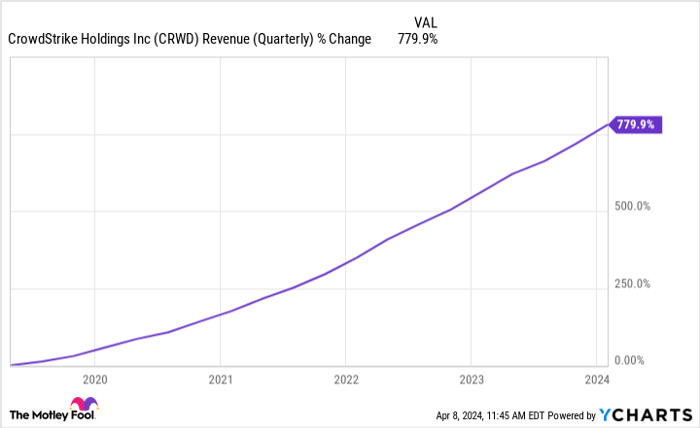

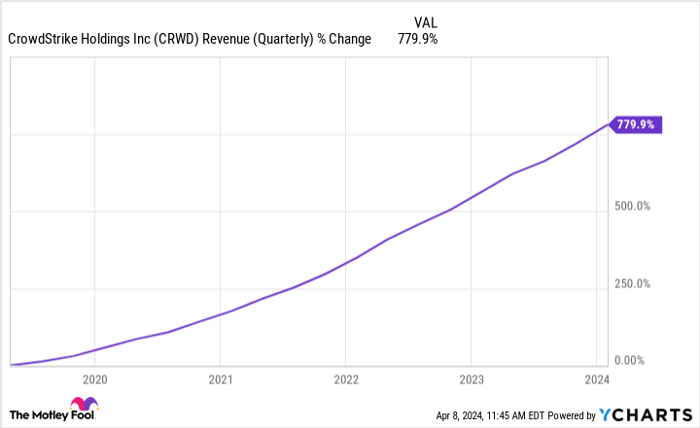

CRWD Revenue (Quarterly) data by YCharts.

CrowdStrike, in partnership with IDC, forecasts the AI-native cybersecurity market to burgeon to $225 billion by 2028, affording ample room for the platform to further entrench its market supremacy and deliver enduring value to discerning investors.

3. Taiwan Semiconductor Manufacturing Company

Donning the hat of a semiconductor foundry, Taiwan Semiconductor Manufacturing Company (TSMC) may not initially scream ‘AI stock,’ yet its indispensability within the AI ecosystem looms large.

Like the inception of a flourishing tree springs forth from a seed, the semiconductors skillfully churned out by TSMC act as the vital seeds in the AI landscape. At the heart of this ecosystem lie data centers, pivotal hubs crucial for amassing the sheer volume of data imperative for AI training. Fuelled by graphic processing units (GPUs), the life force of computing power, these data centers heavily rely on semiconductors crafted by TSMC.

As the unrivaled global leader in semiconductor fabrication, TSMC holds the fort. Boasting clientele giants like Nvidia, TSMC’s superior offerings leave competitors in the dust, cementing its throne as the go-to for industry titans.

Should TSMC falter in its advanced processes, the AI pipeline would undoubtedly stutter, throttling the pace of progress in the field. This reliance alone catapults TSMC to the ranks of pivotal AI-adjacent firms, with AI-related semiconductors projected to contribute significantly (high teens) to TSMC’s revenue by 2027.

TSMC might be just one amongst the AI-savvy semiconductor foundries, but it reigns supreme as the linchpin.