ChargePoint (NYSE: CHPT) finds itself amidst the whirlwind of the electric vehicle (EV) revolution, akin to a steadfast “picks and shovels” firm, facilitating the infrastructure that fuels electric cars. For potential investors eyeing a stake in this novel fueling station domain, three pivotal facts demand scrutiny.

1. Buckle Up for Volatility in ChargePoint Stock

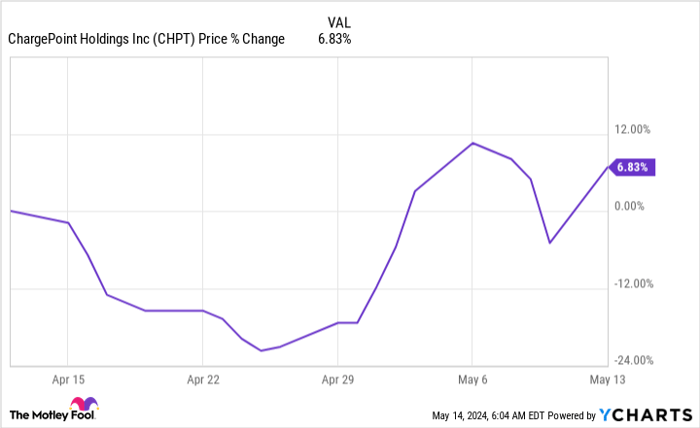

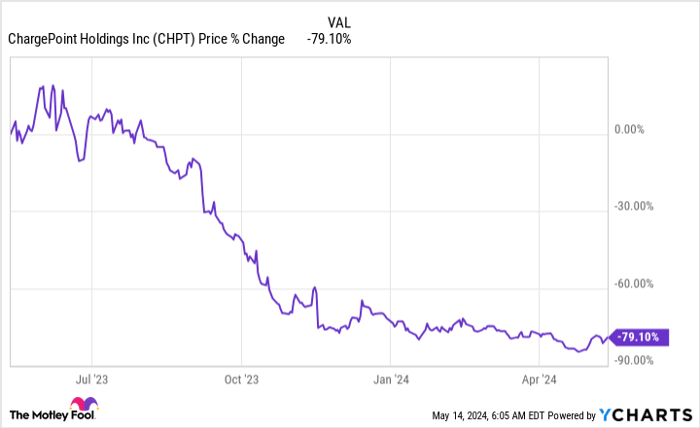

Recently, ChargePoint shares have undergone a meteoric ascent. While no company-specific development can be pinpointed as the catalyst, the strategic downsizing of employees in the EV manufacturer Tesla’s charging network has stirred speculation. Could this herald Tesla’s intentions to delegate infrastructure expansion to entities like ChargePoint? This shift might present fresh avenues for ChargePoint’s growth by reducing competition. Yet, the trajectory remains tumultuous; the stock has plunged roughly 80% in the past year, and over 95% from its peak.

CHPT data by YCharts

Partaking in ChargePoint means traversing a perilous investment terrain, akin to navigating the resurgence of certain meme stocks that exhibit capricious trajectories.

2. Capital Drain: The Costly Expansion Odyssey

ChargePoint’s potential lies in fostering the burgeoning age of electric vehicles that displace conventional internal combustion cars. With a robust presence in charging locations throughout North America and Europe, ChargePoint flaunts a varied growth strategy, spanning from charging device sales to subscription services. However, transformative progress incurs a hefty price.

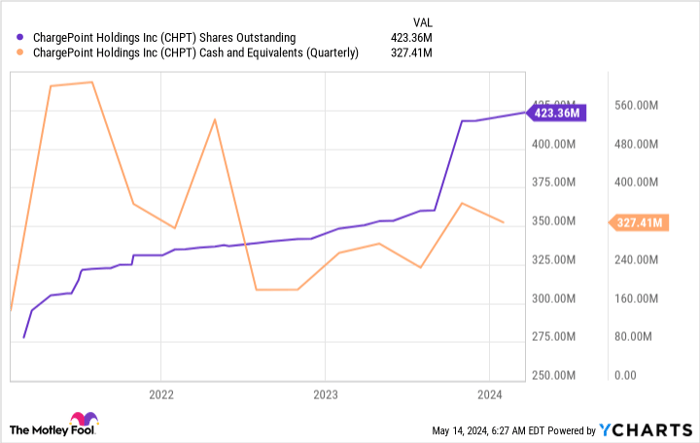

The fiscal year 2024 witnessed soaring research and development costs, totaling about $220.8 million, coupled with marketing expenditures of roughly $150.2 million and administrative outlays nearing $109.1 million. Despite concluding the year with a raised capital pool—primarily through share issuances—there prevails a stark truth: the road to expansion is lined with escalating fiscal commitments, persisting into the foreseeable future.

CHPT data by YCharts

Share dilution signals a dire imperative for ChargePoint—expanding its charging network commands a continuous infusion of capital, entailing unabated shareholder dilution to perpetuate growth. This trajectory will likely persist, as signaled in ChargePoint’s 10-K statement, acknowledging, “ChargePoint has propelled substantial growth in a swiftly evolving industry and anticipates ongoing investments in expansion.”

3. Stranded in Red Seas: ChargePoint’s Ballooning Losses

Scrutinizing the revenue-expenditure spectrum reveals a stark narrative of persistent losses. Revenues of $506 million, counterpoised against $476.5 million in costs of revenue, yield a meager gross profit of $30.1 million. Once operating expenses of $480 million are deducted, a gaping full-year loss of $1.22 per share emerges, painting a bleaker picture than the preceding fiscal year’s loss of $1.02 per share.

CHPT Shares Outstanding data by YCharts

The cash-burning trajectory appears intransigent, as evidenced by the 10-K’s admonition: “ChargePoint operates in the nascent stages of EV adoption, marked by persistent losses and negative operational cash flows, and anticipates enduring losses and substantial expenses in the near term.” Embracing ChargePoint today implies embarking on a voyage through sustained operational build-out and the attendant red ink it seems destined to spawn. Hence, most discerning investors may opt to observe from a cautious distance.

Striving for Victory Amidst Perilous Pathways

None of the foregoing undermines ChargePoint’s eventual potential to metamorphose into a profitable juggernaut, wielding a preeminent position in the EV charging domain. Nonetheless, current indicators scarcely point to imminent profitability. The company faces an arduous ascent out of the abyss of deficit, exacerbated by industry vicissitudes in an emergent sector. This compounds the innate volatility of an already capricious stock. Unless armed with an unwavering bullish stance on ChargePoint and fortified nerves, prudent investors may heed to steer clear of this stock.

Should You Venture $1,000 into ChargePoint’s Turbulent Waters?

Before contemplating an investment in ChargePoint, contemplate this:

The Motley Fool Stock Advisor analysts have decisively singled out what they perceive as the best

Unveiling Top Stocks for Savvy Investors

Missing the Charge: Stock Advisor’s Top Picks

When it comes to stock investments, there are always standouts that defy the odds. However, amidst the frenzy of seeking out lucrative opportunities, one notable absence has caught the eyes of many: ChargePoint. While the 10 chosen stocks pack a punch and are poised to deliver substantial returns, the exclusion of ChargePoint has raised some eyebrows.

Historical Glimpse: Nvidia’s Path to Riches

Back in the day, specifically on April 15, 2005, Nvidia found itself on a similar list. Imagine this: if you had heeded the advice and decided to invest $1,000 at that moment, the jaw-dropping result would have been $566,624 in your pocket today! Such historical instances serve as potent reminders of the wealth-generating power lurking within strategic stock picks.

The Stock Advisor Chronicle

Enter Stock Advisor, the beacon guiding investors through the maze of financial markets. This service doesn’t just hand out stock recommendations; it equips investors with a roadmap to success. Amidst the clutter and noise, Stock Advisor delivers clarity, offering insights on portfolio construction, frequent updates from analysts, and a bi-monthly dose of fresh stock picks.

Stock Advisor’s track record is nothing short of remarkable. Since its inception in 2002, it has outperformed the S&P 500 by more than fourfold. A testament to its prowess in identifying opportunities that fuel growth and drive substantial returns.

A Glimpse of Perfection: Unveil the Top Stocks

For investors hungry for the next big win, the top 10 stocks hold the promise of significant gains. As the stock market continues its ever-evolving dance, these gems have been carefully selected as potential heavyweights ready to skyrocket in the years to come.

Curious to see the chosen few that made the cut? A peek behind the curtain promises a journey to financial enlightenment.

*Stock Advisor returns are as of May 13, 2024