One: indie Semiconductor

Indie Semiconductor (INDI) is making big waves in the semiconductor industry, offering cutting-edge automotive semiconductors and software solutions. With a market capitalization of $1.15 billion, this California-based company is tapping into the high-demand market for applications like Advanced Driver Assistance Systems (ADAS) and in-vehicle entertainment.

The recent 34.2% and 24% dips in INDI’s shares over the past year and year-to-date, respectively, do not dampen its prospects. The company stands to benefit from a thriving automotive semiconductor market that is projected to grow at a compound annual growth rate (CAGR) of 11% between 2022 and 2027.

Indie Semiconductor has secured partnerships with major players like Ford, General Motors, and Volkswagen, positioning itself as a key player in the industry. The company’s announcement of the iND880xx product line further cements its foothold in the market, focusing on meeting the evolving requirements of driver assistance systems.

Strategic Moves and Financials

Despite missing revenue expectations for the first quarter of fiscal 2024, indie Semiconductor is not shying away from innovation. With a strong focus on research and development, the company is investing in future product iterations to stay ahead in the game.

Acquisitions have played a pivotal role in indie Semiconductor’s growth strategy. Its recent acquisition of Kinetic Technologies underscores its commitment to expansion and innovation.

Looking ahead, indie Semiconductor aims to return to high-growth mode in the latter part of 2024, eyeing EBITDA profitability by Q4. Analysts foresee a shift from losses to profits in the coming years, with revenue projections painting a promising picture for the company’s growth trajectory.

Two: Rambus Inc.

Rambus (RMBS), valued at $6.33 billion, is a key player in developing high-speed chip-to-chip interface technology. This technology powerhouse focuses on enhancing the performance and cost-effectiveness of consumer electronics and computer systems.

Collaborating with major chipmakers like AMD, Broadcom, and Nvidia, Rambus has established itself as a go-to provider for cutting-edge chip technology. The 8.4% dip in its shares over the past year does not overshadow its potential for growth in the industry.

Future Prospects

Both indie Semiconductor and Rambus hold promising prospects in the semiconductor landscape, each carving out a niche with innovative products and strategic partnerships. As the semiconductor industry continues to evolve, these companies are poised to capitalize on the growing demand for advanced technological solutions.

The Rise of Rambus and Silicon Motion Technology in the Technology Sector

Rambus: Pioneering High-Performance Memory Solutions

Rambus, a prominent chip interface developer, finds itself in a fortuitous position to ride the wave of the burgeoning demand for high-performance memory solutions in the AI and data center markets. As data usage skyrockets due to cloud computing and artificial intelligence, Rambus takes center stage in facilitating swift and secure data connections across diverse hardware systems.

Analyst Acclaim and Strategic Moves

Recent accolades by analysts underscore the company’s potential for robust growth. Rosenblatt highlighted Rambus among their top technology stock picks, stressing the pivotal role of its DDR5 modules in various AI servers and signaling an opportunity to acquire undervalued shares. Jefferies analyst Blayne Curtis bestowed a “Buy” rating on Rambus, with a bullish outlook on U.S. semiconductor stocks, foreseeing substantial gains from AI advancements.

Financial Fortitude and Forward-Looking Strategy

Rambus exhibited financial strength in its Q1 earnings report, with a notable 68.5% surge in royalty revenue driving a 3.6% year-over-year increase in total revenue. Despite a slight miss on consensus estimates, the company showcased improved bottom-line performance. Ending the quarter debt-free with considerable cash reserves, Rambus is well-poised for shareholder rewards, including share buybacks and strategic investments for future growth.

Growth Trajectory and Investor Sentiment

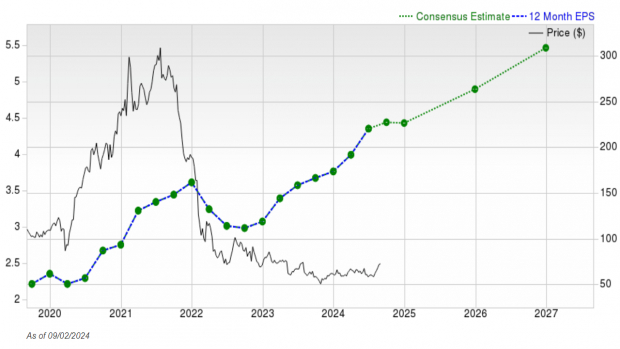

Forecasts point towards a bright future for Rambus, with expected earnings and revenue growth for fiscal 2024. Although trading at a premium compared to industry peers, the stock’s higher valuation aligns with heightened investor expectations in the AI domain, driving optimism and sustained interest in the company. With a unanimous “Strong Buy” recommendation from analysts and a promising upside potential, Rambus garners significant investor confidence.

Silicon Motion Technology: Driving Innovation in Semiconductor Products

Hailing from Hong Kong, Silicon Motion Technology Corporation (SIMO) stands out as a global frontrunner in supplying NAND flash controllers and solid-state storage devices, catering to a diverse array of markets – from consumer electronics to enterprise storage and mobile communications. Its market cap currently stands at an impressive $2.73 billion.

Innovation and Market Dominance

Silicon Motion’s focus on NAND flash memory, a key non-volatile storage technology, underscores its essential role in devices like smartphones, solid-state drives, and memory cards. The efficiency and reliability of NAND flash in compact storage solutions drive its popularity across various industries, showcasing Silicon Motion’s market influence and technological prowess.

Analyst Endorsement and Performance Surge

Renowned analyst Ray Wu from Morgan Stanley upgraded Silicon Motion to “Overweight,” citing the company’s readiness to capitalize on AI advancements. The firm’s heightened price target and revenue outlook reflect strong growth prospects driven by an expanding product portfolio and exposure to the PC market. With a robust Q1 performance and raised full-year revenue guidance, Silicon Motion resonates positively with investors and analysts alike.

Silicon Motion Rides High on Strong Q1 Performance

Breaking Through Projections

Surpassing analysts’ expectations by $0.07, Silicon Motion impressed investors in its latest financial quarter. The company’s non-GAAP gross margin escalated to an impressive 45% from 42.3% compared to the same quarter a year earlier. This enhancement stemmed from a well-curated product mix and an increase in average selling prices, strongly bolstering profitability.

Vision for the Future

President and CEO of Silicon Motion, Wallace Kou, expressed his satisfaction in the Q1 performance, citing exceptional demand and better profitability driven by surging average selling prices. With a consistent streak of growth in SSD revenue over the past four quarters and an optimistic outlook for the rest of 2024, Silicon Motion stands firm in its resolve to expand its business and enhance profitability.

Upward Trajectory

Looking forward to Q2 2024, Silicon Motion’s management anticipates revenue to fall within the range of $199 million to $208 million. The company expects further improvement in gross margin, landing between 45% and 46%, while operating margin is projected to strengthen ranging from 16.5% to 17.5%. Moreover, Silicon Motion has revised its FY2024 revenue guidance to $800 million to $830 million, reflecting an impressive year-over-year growth rate of 25-30%.

Analyst Projections

Analysts foresee a 53.58% increase in EPS to $3.49 for fiscal 2024, with revenue expected to climb by 28.31% to $820.11 million year-over-year. These promising projections indicate a bright future for Silicon Motion in the upcoming quarters.

Financial Insights

On the dividend front, the company’s annualized dividend of $2.00 translates to a forward yield of 2.47%, significantly higher than the sector’s median of 1.47%. With a forward earnings multiple of 23.23x, Silicon Motion trades slightly below the sector’s median of 23.97x but notably higher than its five-year average of 16.09x.

Market Outlook

Despite the recent success, Silicon Motion stock retains an optimistic outlook. Analysts unanimously rate the stock as a “Strong Buy,” with the average price target of $94.78 indicating a potential 17% upside from the latest closing price. This resounding endorsement from industry experts reflects the confidence in Silicon Motion’s growth trajectory.