As the U.S. House of Representatives recently passed a bill with the potential to ban TikTok, investors are on high alert for the impending consequences. The looming threat of Chinese app bans has the market at the edge of its seat, bracing for potential aftershocks. If this bill secures U.S. Senate ratification, the ripple effects could reverberate across several U.S. companies and the stock market landscape, sparking a wave of negative reactions. With a resounding 352 to 65 vote in favor, it is evident that the U.S. government perceives TikTok as a substantial threat, paving the way for ByteDance to potentially offload its TikTok division. This impending scenario compels investors to consider which stocks to exit in anticipation of Chinese app bans.

The dynamics of this shift in U.S. policy towards foreign entities could cast a long shadow over future Chinese listings on U.S. exchanges, sending shockwaves through various sectors that heavily rely on TikTok for marketing purposes. It’s imperative to steel yourselves for the likelihood of Chinese companies being caught in the crossfires of a burgeoning economic Cold War.

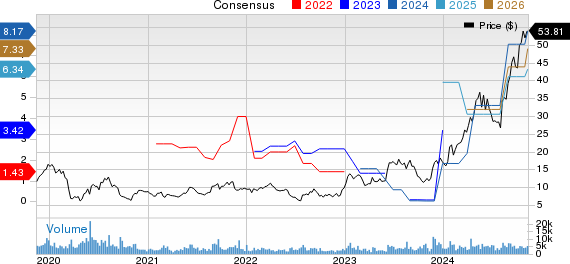

Shifting Focus – PDD Holdings (PDD)

Providing a backdrop of agile resilience, PDD Holdings (NASDAQ:PDD) could stand to gain in the immediate aftermath of the TikTok ban, courtesy of its subsidiary, Temu. Positioned as a cost-efficient rival to Amazon in the e-commerce realm, PDD Holdings offers itself as a budget-friendly alternative for the discerning consumer. While engaging in a tussle with TikTok Shop by facilitating sales of economical Chinese merchandise directly from manufacturers, Temu relies heavily on high-cost social media promotions to ramp up its consumer outreach mechanisms.

Moreover, with sentiments towards Chinese firms souring among U.S. retail investors, the possible prospect of swift divestment looms large, particularly if the U.S. government signals a willingness to blacklist companies on national security grounds. Consequently, PDD’s price stability might witness turbulent times post the TikTok ban. It’s worth noting that Temu is a relatively nascent player in the U.S. market still striving to solidify its brand image, a task further compounded by the lukewarm reception from American shoppers owing to the perceived quality of offerings on the platform.

Navigating the Winds – Alibaba (BABA)

Operating as the virtual doppelganger of Amazon within the Chinese borders, Alibaba (NYSE:BABA) stares down similar challenges in the event of a TikTok ban in the U.S. Commanding authority across the Chinese e-commerce landscape by offering pocket-friendly wares sourced directly from domestic manufacturers, Alibaba’s international footprint primarily rests on AliExpress and a handful of cloud computing services. Any change in U.S. governmental stance could spell trouble for Alibaba’s global endeavors.

Crucially, AliExpress hinges on expanding its reach into overseas markets, notably in Europe and South America, regions that showcase staunch resistance to Communist ideologies. Should these quarters follow suit in prohibiting TikTok, Alibaba might grapple with upholding its esteemed standing in Western domains. This existential crisis could prompt retail investors to rethink the viability of Chinese equities in their portfolios.

Bracing for Impact – HelloFresh (HELFY)

Standing tall among the ranks of the highest spenders on TikTok advertising, HelloFresh (OTCMKTS:HELFY) faces an exposure crunch in the face of a potential TikTok ban. Renowned for its prowess in social media marketing, HelloFresh relies heavily on succinct ad campaigns to spread the word about its meal kit delivery services. A TikTok blackout, with its outreach to over 170 million Americans annually, could compel HelloFresh to pivot towards pricier advertising platforms.

This sea change could dent the company’s marketing expenditures and overall revenues from newly onboarded clientele. Furthermore, HelloFresh’s ad content resonates strongly on TikTok, leveraging the app’s fertile ground of food enthusiasts. As one of the front-runners expected to exit before the Chinese app bans unfurl, HelloFresh might witness a stock value dip. However, in the grand scheme, HelloFresh’s operational model can weather the storm sans TikTok reliance.

On the publication date, the author had no positions in the securities discussed in the article, directly or indirectly. The opinions penned here are solely those of the writer, adhering to the InvestorPlace.com Publishing Guidelines.

Renowned for decoding the intricate world of tech stocks with meticulous accuracy, Viktor Zarev boasts a diverse background as a scientist, researcher, and writer.

Engage Further: Dismantling the Implications

In the wake of the impending Chinese app bans, strategic moves are crucial to safeguarding investments. Prepare for the reshaping forces at play. Find more insightful nuggets here.