Crocs Back in Business

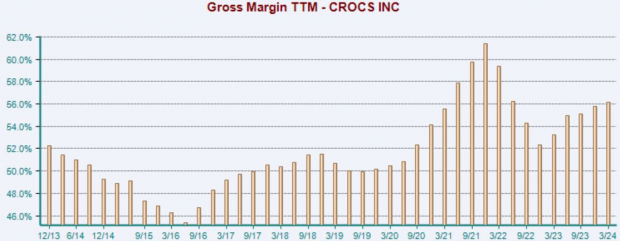

After a robust performance in the first quarter, Crocs has leaped back into the limelight with a stunning display of financial prowess. Reporting $732 million in quarterly revenue, a 10% increase from the previous year, Crocs has left its competitors trailing behind. Despite a decline in HEYDUDE sales by 18%, the company managed to surpass the Zacks Consensus EPS estimate by an impressive 34%. This achievement is complemented by a solid margin expansion, with the gross margin increasing to 55.3% in the fourth quarter, up from 52.5% in the same period last year.

Walmart’s Dominance

Amidst the swirling tides of uncertainty, Walmart stands tall with a formidable 15% beat relative to the Zacks Consensus EPS estimate in its recent financial report. Additionally, the retail giant outperformed sales expectations by 1.3%, showcasing a robust growth trajectory. With a 22% increase in earnings and a 6% surge in sales compared to the previous year, Walmart’s shareholder-friendly approach shines through. The company’s consistent increase in quarterly payout over the last five years, currently yielding at 1.3% annually, reflects its commitment to rewarding investors.

e.l.f. Beauty’s Radiant Glow

e.l.f. Beauty has soared to new heights post-earnings, staging a dramatic turnaround after a period of stagnation. With shares skyrocketing nearly 30% in 2024, the company has outpaced the S&P 500, emerging as a beacon of success. Bolstered by a track record of beating consensus estimates for 10 consecutive quarters, e.l.f. Beauty’s growth trajectory is nothing short of phenomenal. The latest financial results underline this trend, with earnings surging by 15% and a remarkable 71% boost in sales, ushering in a new era of prosperity.

The Path Ahead

As the dust settles on the hectic earnings season, the exemplary performances of Crocs, Walmart, and e.l.f. Beauty stand out as beacons of hope in a volatile market landscape. The resilience and adaptability displayed by these companies underscore their potential for sustained growth and investor returns. The trailblazing success of these industry leaders not only reaffirms their positions in the market but also sets a high benchmark for future endeavors.