Stocks have been ablaze this year, with the Nasdaq Composite index surging 8% since the dawn of 2024. This ascent follows the fervor of the previous year, where tech stocks set the sky ablaze with a 43% surge. The flames of excitement have been fanned by burgeoning sectors like Artificial Intelligence (AI), attracting investors enthralled by the increasing demand for such services, propelling the entire tech market. The fire of AI growth shows no sign of dimming and is poised to kindle stocks across the industry in 2024, with numerous companies and associated markets basking in its warmth.

Just as the age-old adage professes, “The best time to plant a tree was 20 years ago, and the next best time is now,” the same goes for investing.

Here are three stocks that could ignite your wealth in 2024.

1. Advanced Micro Devices: Lighting the Way

As a prominent chipmaker, Advanced Micro Devices (NASDAQ: AMD) shines brightly this year and in the foreseeable future. The company supplies hardware to various tech entities, with its chips empowering a plethora of devices from cloud platforms to video game consoles, AI models, custom-built PCs, laptops, and more.

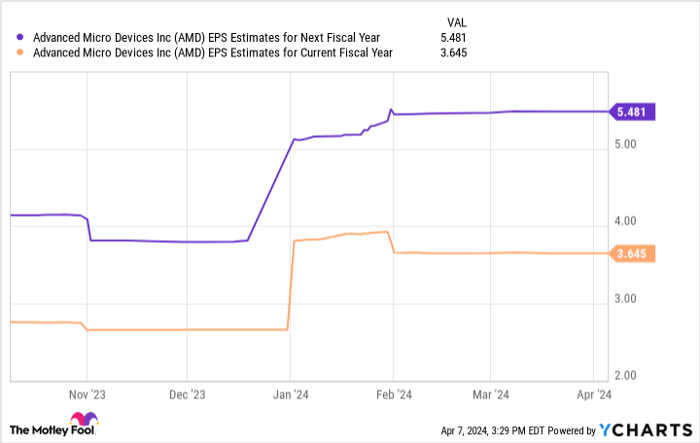

AMD has witnessed a meteoric rise, with its revenue soaring by 240% over the past five years and its free cash flow surging by 306%. The company’s investment in AI is paramount. In December, AMD unveiled its MI300X AI graphics processing unit (GPU), primed to rival Nvidia’s offerings, attracting tech giants like Microsoft and Meta Platforms as clients.

While AMD’s earnings have yet to fully reflect its AI investments, its recent quarterly results are promising. In the fourth quarter of 2023, AMD’s revenue ascended by 10% year over year to $6 billion, surpassing analysts’ expectations by approximately $60 million. The segment focusing on AI-centric data centers experienced a robust 38% increase in revenue.

This trajectory indicates that AMD is a scorching buy in 2024 as it expands its horizons and benefits from the AI surge.

2. Intel: Rekindling the Flame

Chip demand in the tech realm is skyrocketing, suggesting that one can’t have too many chip stocks in their portfolio, and Intel (NASDAQ: INTC) stands out as another compelling option.

Although Intel has faced challenges in recent years, enduring a 41% stock decline over the past three years due to dwindling market share in central processing units (CPUs) and severing a decade-long partnership with Apple, the company seems to have found renewed vigor to reignite its sparks in the years ahead.

Last June, Intel announced a paradigm shift in its business, embracing an internal foundry model expected to yield $10 billion in savings by 2025. Furthermore, Intel is venturing into the realm of AI. In December 2023, the company introduced a range of AI chips, including Gaudi3, a GPU posing a challenge to Nvidia’s offerings. Intel also showcased new Core Ultra processors and Xeon server chips, integrating neural processing units to enhance the efficiency of AI operations.

Projections show Intel’s earnings reaching over $2 per share within the next year. When multiplied by the company’s forward Price-to-Earnings (P/E) ratio of 28, this forecast translates to a stock price of $65.

Given its current trajectory, these estimates could propel Intel’s stock by 67% by fiscal 2025, rendering it a must-have investment opportunity at present.

3. Amazon: Reigniting the Blaze

The stock of Amazon (NASDAQ: AMZN) has soared by 81% in the past year, enriching numerous investors along its fiery path.

Over the previous decade, the company’s business has soared to towering heights, establishing itself as a frontrunner in e-commerce and the cloud domain, with its annual revenue and operating income skyrocketing by 546% and 20,000%, respectively, since 2014.

Amazon’s AI endeavors have been under the spotlight this year. As the operator of AWS, the world’s largest cloud service, Amazon is poised to leverage its extensive cloud data centers to navigate the generative AI landscape. In 2023, AWS responded to the escalating demand for AI services by introducing a suite of new tools, hinting at a substantial earnings boost in the years to come.

Projections indicate that Amazon’s earnings could hit $5 per share over the next two fiscal years. Multiplying this figure by Amazon’s forward P/E of 44 yields a stock price of $237, implying a 28% surge in its stock value by fiscal 2025. While this anticipated growth may not match the magnitude of AMD and Intel, it surpasses the S&P 500’s 26% rise over the past year, making Amazon a stock worthy of contemplation at this juncture.

Unraveling The Investment Potential of Advanced Micro Devices

Investing Insights

Should you invest $1,000 in Advanced Micro Devices right now?

Before diving into the world of AMD stocks, consider this:

The prestigious Motley Fool Stock Advisor analyst team recently unearthed an intriguing discovery. While unveiling the 10 best stocks poised for significant growth, Advanced Micro Devices didn’t make the cut. The selected 10 stocks are forecasted to yield substantial returns in the foreseeable future.

Stock Advisor Service

The Stock Advisor service functions as a treasure map for investors, charting a course for success. Offering valuable insights on portfolio construction, regular expert updates, and a pair of fresh stock suggestions every month, it has outperformed the S&P 500 by more than threefold since its inception in 2002.*

*Stock Advisor returns as of April 8, 2024