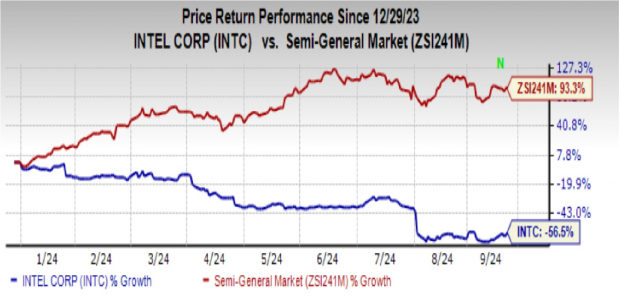

Intel Corporation INTC investors weathered storms this year, facing plunging stock prices amidst struggles in the foundry business. The turmoil culminated in dividend suspensions and job cuts, plunging shares by 57%, a stark contrast to the Semiconductor – General industry’s 93.3% growth. Intel’s failure to seize AI opportunities further marred its performance.

But, a recent triumvirate of events witnessed Intel’s stock rebounding by over 11%, marking its best weekly surge since November. While investors cheered this uptick, is it a harbinger of sustained growth or a mere ephemeral boost?

Resurgence of Intel Stock

Intel’s bold move to spin off its foundry business provided a much-needed impetus. Reports of a potential acquisition by QUALCOMM Incorporated QCOM and a strategic partnership with Amazon.com, Inc. AMZN added fuel to the fire, propelling shares skyward.

The whirlwind week buoyed optimism among investors, hinting at brighter days ahead. Wall Street’s whispers of a Qualcomm takeover sparked fresh interest in Intel, as the synergy between their products promises mutual benefits.

Rationalizing the Stock Surge

Qualcomm’s approach to Intel suggests a fruitful collaboration on the horizon. Intel’s proficiency in PC and server chips, juxtaposed with Qualcomm’s mobile prowess, presents a tantalizing prospect for both entities. Should a deal materialize, enhanced market positioning is inevitable.

Furthermore, Intel’s alliance with Amazon heralds a resurgence. Leveraging Intel’s chip designs could catapult Amazon Web Service (AWS) to new heights, particularly in light of NVIDIA’s inflated pricing strategies.

The transition of Intel’s foundry business into a subsidiary serves as another bullish sign. By fortifying this struggling segment and bolstering funding, Intel eyes a renaissance in its chip manufacturing realm, vying with industry stalwarts like Taiwan Semiconductor Manufacturing Company Limited TSMC.

Intel’s Outlook: To Buy or Not to Buy?

CEO Patrick Gelsinger’s strategic gambits underscore a promising trajectory for Intel. Analysts’ revised short-term price targets paint an optimistic picture, with a potential 212.2% upside projection.

Yet, challenges loom large on Intel’s horizon. Fierce competition from Advanced Micro Devices, Inc. AMD and Arm Holdings plc ARM pose significant threats to Intel’s dominance. Additionally, Intel’s steep valuation metrics, trading at 81.3X forward earnings against the industry’s 47.7X, raise red flags.

Investors treading the Intel waters must proceed cautiously amid the turbulent market tides. Staying the course might yield substantial rewards once Intel realizes its ambitious visions and reclaims its industry standing.

For now, Intel holds a Zacks Rank #3 (Hold), urging investors to exercise prudence amidst the turbulent market winds. The allure of Intel’s potential remains tantalizing, beckoning savvy investors to venture forth with measured optimism.

The Rise of Tech Giants and Semiconductors

Analyzing the Tech Industry Leaders

Recent market buzz surrounds tech behemoths such as Amazon.com Inc., Intel Corporation, QUALCOMM Incorporated, Advanced Micro Devices Inc., NVIDIA Corporation, ARM Holdings PLC Sponsored ADR, and Taiwan Semiconductor Manufacturing Company Ltd. Analysts are closely eyeing these industry giants as they navigate the dynamic landscape of technology advancements.

Taiwan Semiconductor Manufacturing in the Limelight

One standout entity in the mix is Taiwan Semiconductor Manufacturing Company Ltd. With the surge of semiconductor demand in various sectors, Taiwan Semiconductor Manufacturing finds itself at the helm of innovation, steering the course for a promising future in the semiconductor domain.

The Intel Stock Saga

Despite market turbulence, Intel Corporation managed to wrap up the week on a high note. The rally sparked discussions among investors, with many contemplating the opportune moment to take a leap of faith and delve into the world of Intel stocks. The stock’s performance serves as a testament to the resilience and potential of Intel Corporation in the volatile stock market environment.

Encouraging Signs for the Tech Titans

As tech giants continue to shape the digital realm, investors are keeping a keen eye on the growth trajectories of companies like Amazon.com Inc., QUALCOMM Incorporated, Advanced Micro Devices Inc., NVIDIA Corporation, and ARM Holdings PLC Sponsored ADR. Each player brings its unique strengths and strategies to the table, adding layers of intrigue to the ever-evolving tech saga.