In the tumultuous landscape of the tech industry, where fortunes can change as swiftly as lines of code, Nvidia stands as a titan amidst the turmoil. As the Nasdaq-100 Technology Sector index weathered a 40% plunge in the throes of a recent economic downturn, Nvidia rose like a phoenix from the ashes, capturing the attention of investors far and wide.

The “Magnificent Seven” – an elite cadre comprising Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla – symbolizes the apex of technological prowess. These companies, collectively steering the winds of innovation, have zoomed towards a brighter horizon, fueled by advancements in artificial intelligence (AI) and cloud computing.

Nvidia’s Reign at the Pinnacle of AI

At the zenith of this group stands Nvidia, a company that has not merely embraced but practically personified the AI revolution. With a stranglehold on 80% to 95% of the AI graphics processing unit (GPU) market, Nvidia’s dominance echoes across the tech landscape like a booming thunderclap.

The company’s recent financial performance reads like a tale of legendary conquests – a 265% revenue surge year over year, soaring operating income touching almost celestial heights, and a 409% upsurge in data center revenue, all propelled by the hungry maw of the AI GPU market.

A Window of Opportunity: Nvidia’s Intrinsic Value

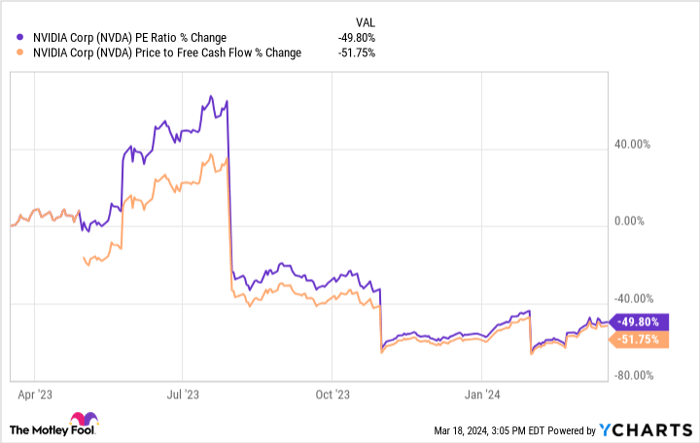

Despite Nvidia’s meteoric rise, a glance into its market valuation reveals a different tale. The ebb and flow of its stock price over the past year points to a moment of equilibrium – a unique juncture where value-conscious investors may find solace in the numbers. As price-to-earnings and price-to-free-cash-flow ratios plummet, Nvidia emerges as a phoenix of intrinsic value, ripe for the taking.

Charting the Course: Nvidia’s Future Trajectory

Nvidia’s prowess extends beyond the realms of AI, with a significant foothold in the revival of the PC market. As Gartner reports a slight uptick in PC shipments, Nvidia rides this wave with a 56% uptick in revenue from its PC-centric gaming segment. Armed with a robust legacy in AI and a resurgence in the PC sector, Nvidia’s future gleams like a polished gem.

The dawning horizon brings forth tantalizing prospects for Nvidia’s earnings-per-share estimates. Projections suggest a bullish trajectory, with potential EPS hitting the $35 mark by fiscal 2026. This translates to a potential stock price surge of 41% over the next two years, eclipsing the S&P 500’s modest growth. Nvidia’s star, while it may not soar as rapidly as before, still shines bright for discerning investors.

As the sands of time continue to shift in the tech industry, Nvidia’s journey stands as a testament to resilience, innovation, and the unyielding spirit of progress. The stock market, a tempestuous sea of opportunities and risks, beckons investors to steer their course towards the promising shores of Nvidia’s future.