Investors have witnessed Nvidia’s meteoric rise over the past year, with shares soaring about 230%. The company’s reign as the dominant force in AI chips and its potential for growth in the PC market make it an intriguing investment opportunity.

Nvidia’s Unassailable Position in AI

Nvidia has firmly secured an estimated 90% market share in AI chips, driven by the company’s long-standing dominance in graphics processing units (GPUs). While competitors such as AMD and Intel are set to introduce new AI chips, history indicates that Nvidia is positioned to maintain its supremacy in this space.

Moreover, projections for the AI market to exceed $1 trillion by 2030 signal ample room for Nvidia to retain its lead and accommodate potential competitors.

A Resurgence in the PC Market

After enduring a challenging period due to macroeconomic headwinds and reduced consumer spending, the PC market is showing signs of recovery. Nvidia’s gaming segment, which encompasses PC component sales, reported an impressive 81% revenue growth in the latest quarter. This sets the stage for Nvidia to capitalize on the improving PC market.

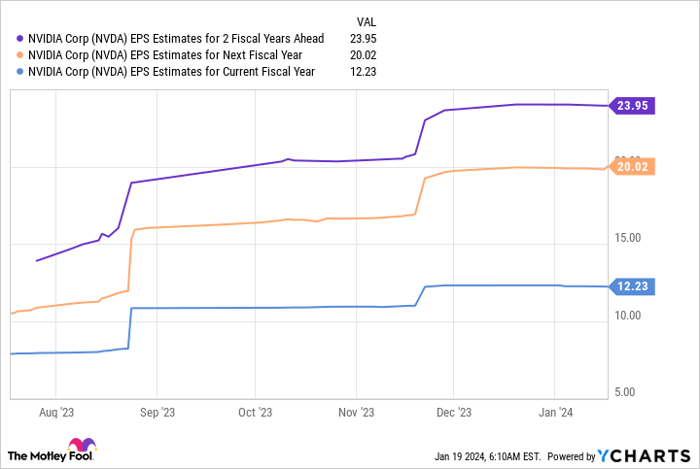

Potential Upside Revealed by EPS Estimates

While Nvidia’s forward price-to-earnings ratio might appear high, EPS estimates tell a compelling story. Projections indicate that Nvidia’s earnings could reach nearly $24 per share by fiscal 2026. When coupled with the company’s forward P/E ratio, this suggests a potential stock price of $1,128 per share, signaling considerable upside potential.

With its strong position in AI and a rebounding PC business, Nvidia’s stock presents a compelling case for investment in 2024.

Before considering an investment in Nvidia, investors should weigh various factors and conduct thorough research.