Microsoft: The Unsung Hero

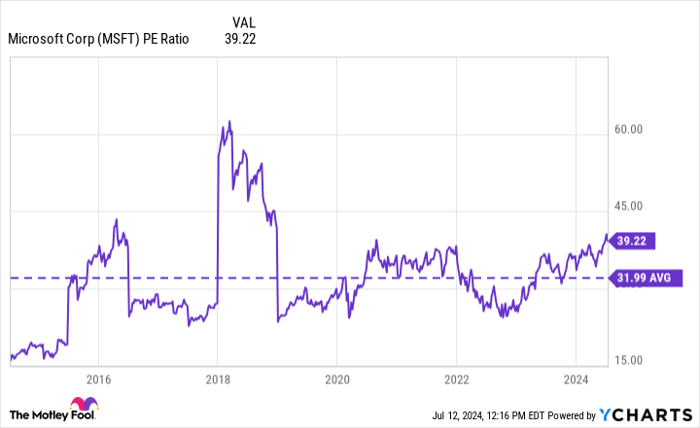

While Nvidia may get all the glory, Microsoft quietly shines as a strong performer among the Magnificent Seven stocks. Over the past three years, it has been the second-best performer in this elite group. Despite its current price-to-earnings ratio of around 39 and vulnerability to market corrections, Microsoft’s deep-rooted ecosystem gives it a unique advantage.

Unlike other tech giants, Microsoft’s stronghold in critical enterprise-focused industries through products like PCs, Office software, Azure cloud services, and LinkedIn, provides a shield against downturns. Businesses worldwide rely on Microsoft, ensuring a degree of stability that sets it apart. Though not immune to risks, Microsoft’s long-term stability and growth potential make it a compelling investment – a gem amidst the tech giants, worth a careful consideration.

Alphabet: Google’s Dominance Continues

Alphabet, predominantly driven by Google, stands out as a compelling investment option despite its 34% surge this year. The unassailable supremacy of Google’s search business globally, with a staggering 90% market share, bodes well for Alphabet’s future. The robust advertising arm, particularly Google Search, represents a significant revenue driver for the company, accounting for over 78% of its earnings.

While advertising remains a key revenue stream, the growth of Google Cloud, with a remarkable 371% increase in operating income in Q1, adds to Alphabet’s promising outlook. With the recent announcement of a quarterly dividend and a leading position in search coupled with a thriving cloud business, Alphabet is primed for sustained growth, making it a strong contender for tech investors.

Amazon: Beyond the E-Commerce Giant

Though Amazon’s genesis as an e-commerce titan is well-known, its strategic diversification is what sets it apart. Anticipating the significance of cloud services early on paid dividends for Amazon, with Amazon Web Services (AWS) emerging as a frontrunner in cloud computing globally. AWS’s superior margins drove over 61% of Amazon’s operating income in Q1, showcasing its significance.

The profitability boost from AWS, being a high-margin segment, alongside the continuous innovation in AI, positions Amazon for sustained growth. Despite e-commerce being the face of Amazon, it’s AWS that fuels its profitability engine, making Amazon a compelling choice for investors looking beyond the obvious.

Amazon’s Ascendancy in Cloud and AI Solutions

The Evolution of Amazon: A Dominant Force in Cloud Computing

Amazon, once known primarily for its e-commerce prowess, has metamorphosed into a dominant force in cloud computing and artificial intelligence solutions. With billions invested in expanding its e-commerce and cloud infrastructure, Amazon now stands at the precipice of leveraging these investments to forge new revenue streams. Notable among these is Supply Chain by Amazon, a comprehensive suite of supply chain services that enables sellers to capitalize on Amazon’s extensive logistics network.

Amazon: A Beacon of Growth and Resilience for Investors

Amazon epitomizes a corporation tailored for sustained growth, endearing itself to investors seeking long-term prospects. The company’s strategic investments in cloud computing and AI solutions have not only enhanced its operational efficiency but have also positioned it as a formidable player in the tech industry landscape. As Amazon continues to bolster its capabilities in cloud and AI technologies, investors can take solace in the company’s unwavering commitment to innovation and growth.

The Unyielding Potential of Amazon in Cloud and AI Ventures

Amazon’s foray into cloud computing and artificial intelligence symbolizes the convergence of technology and commerce, presenting a myriad of opportunities for the company to expand its revenue streams and solidify its market standing. With a track record of visionary investments and strategic foresight, Amazon has established itself as a trailblazer in the realm of cutting-edge technologies, emboldening investors to entrust their capital to a company poised for sustained success.