When it comes to investing, the allure of profit growth is akin to a siren’s call – irresistible and laden with riches. Investing in stocks with promising earnings growth is akin to striking gold in the financial markets. On the horizon of 2024 and beyond, three stocks stand out like beacons in a stormy sea, beckoning investors to pay heed to their potential: NextEra Energy, Clearway Energy, and Ford. These stalwarts have captured the attention of keen-eyed investors for their bright prospects and potential for substantial long-term growth. Let’s delve into the depths of these enticing opportunities and uncover why they are considered no-brainer buys in the current market landscape.

NextEra Energy’s Sparkling Dividend Growth in a Utility Landscape

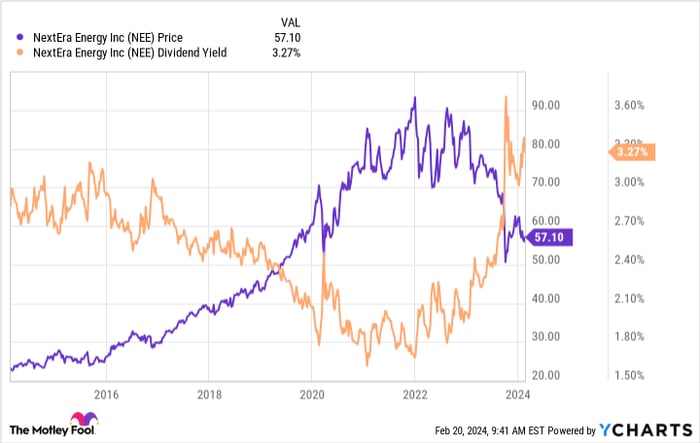

NextEra Energy, a stalwart in the utility sector, stands out for its impressive dividend growth potential. While traditionally lagging in dividend yield compared to its peers, NextEra Energy is currently offering a yield of 3.6%, near its highest in a decade. This tantalizing figure hints at an undervalued stock ripe for the picking, akin to discovering a hidden treasure trove. The company’s unique blend of a regulated utility business and a rapidly expanding renewable energy segment has fueled a remarkable 10% annualized dividend growth rate over the past decade. Such exceptional growth in a typically stable sector is a rare gem, presenting investors with a golden opportunity to diversify their portfolios. With a projected 10% dividend growth rate expected in 2024 and robust earnings growth estimated between 6% to 8% annually through at least 2026, the future shines brightly for NextEra Energy. Seize the chance to acquire this dividend growth utility at an attractive valuation before it vanishes like a fleeting comet in the night sky.

Bright Horizons: Clearway Energy’s Radiant Future

Clearway Energy, a premier player in the renewable energy sector, shines like a beacon of hope for investors seeking robust dividend growth and sustainable investments. As one of the leading renewable energy generators in the nation, Clearway Energy boasts a portfolio of environmentally friendly natural gas power plants and clean energy assets backed by stable cash flows. Attractively yielding 7.1%, the company is on track to enhance its already enticing payout within the 5% to 8% annual target range through 2026. Clearway Energy’s strategic capital recycling approach, highlighted by the successful monetization of thermal assets in 2022, has paved the way for lucrative reinvestment in high-return renewable energy projects. This financial acumen is akin to a skilled artisan carving a masterpiece from rough stone, transforming cash proceeds into a flourishing garden of renewable energy assets. With a clear pathway to bolster cash available for dividends from $342 million to $435 million in the near future and promising growth prospects well beyond 2026, Clearway Energy emerges as a compelling long-term investment. Despite recent market headwinds, this renewable energy titan remains a no-brainer buy for astute investors seeking sustainable and lucrative opportunities in the ever-changing landscape of finance.

Into the Fast Lane: Ford Motor Company’s Journey Ahead

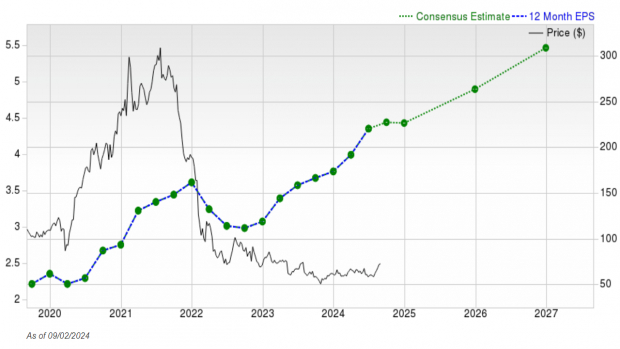

Ford Motor Company, an iconic figure in the automotive industry, is revving up for an exhilarating ride towards growth and prosperity. Despite facing macroeconomic headwinds and internal challenges, Ford’s stock has surged nearly 19% in the past three months, signaling the dawn of a potential bull run for the automaker. Bolstered by robust fourth-quarter and full-year 2023 results, Ford is navigating the twists and turns of the market with agility and determination. The latest developments within the company hint at a future brimming with promise, akin to a sleek sports car racing towards the finish line. As Ford accelerates towards new milestones and embraces innovation in an ever-evolving industry landscape, investors are presented with a compelling opportunity to embark on this exciting journey alongside a stalwart of American automotive history. Buckle up and get ready to ride the waves of growth with Ford Motor Company as it steers towards a future filled with transformation and success.

Ford Revs Up Profits and Growth: A Look Ahead to 2024

Revenue and Profit Surges

In the face of labor strikes and global economic uncertainties, Ford managed to defy the odds and accelerate its revenue growth by an impressive 11% in 2023. The company made a significant financial turnaround by recording a net profit of $4.3 billion, a stark contrast to the $2 billion net loss it incurred in the previous year. This remarkable achievement not only showcases Ford’s resilience but also its ability to adapt and thrive in challenging environments.

Cost Cutting and Strategic Shifts

Besides the impressive financial figures, Ford’s success in 2023 can be attributed to its proactive cost-cutting measures and strategic shifts in its business operations. By reducing capital spending in slower markets and focusing on optimizing profitability, Ford managed to boost its overall profit margins. Notably, the company made a strategic decision to trim down its spending on electric vehicles in response to the global slowdown, opting instead to concentrate on more lucrative ventures such as Ford Pro – its commercial vehicles segment known for generating substantial recurring revenue.

Outlook for 2024

With a bullish outlook for 2024, Ford has set ambitious targets for the year ahead. The company aims to achieve adjusted earnings before interest and tax (EBIT) in the range of $10 billion to $12 billion, surpassing the $10.4 billion recorded in 2023. Additionally, Ford is on track to generate adjusted Free Cash Flow (FCF) between $6 billion to $7 billion. Furthermore, Ford remains committed to providing value to its shareholders by earmarking 40% to 50% of its adjusted FCF for dividends.

Product Launches and Strategic Investments

Looking ahead, Ford has an exciting lineup of product launches scheduled for 2024, including a new iteration of its popular F-150 pickup truck. These new releases are poised to drive further growth and solidify Ford’s position in the market. By strategically investing in product innovation and customer-centric offerings, Ford is positioning itself for sustained success and market leadership.