Overview of Gaming Industry

The gaming industry is experiencing a surge in demand driven by various macroeconomic factors like the recent Federal Reserve interest rate reductions and the increasing popularity of sports betting. Companies within this industry operate integrated casinos, hotels, and entertainment resorts, providing technology products and services such as lotteries, electronic gaming machines, and interactive gaming.

Influence of Key Market Themes

Interest Rate Cut Impact: The recent interest rate cut by the Federal Reserve has significantly aided gaming companies by lowering borrowing costs and freeing up capital for growth initiatives and debt refinancing.

Improving Macau Gaming Revenues: The gaming industry in Macau is experiencing growth, with robust investments and strategic operational enhancements by casino operators contributing to this positive trend.

Robust U.S. Commercial Gaming Revenues: The United States gaming industry is thriving with record-high revenues, driven by consistent growth and positive investor sentiment stemming from ongoing revenue increases.

Sports Betting Driving Growth: The legalization of sports betting across various states has become a major driver for the industry, with digital platforms like DraftKings, FanDuel, and BetMGM gaining significant traction in the market.

Industry’s Promising Outlook

The Zacks Gaming industry is positioned favorably, indicated by a Zacks Industry Rank of #103, placing it in the top 41% of Zacks industries. Analysts are increasingly optimistic about the industry’s earnings growth potential, with a 9.5% increase in earnings estimates since April 2024.

Performance and Valuation Analysis

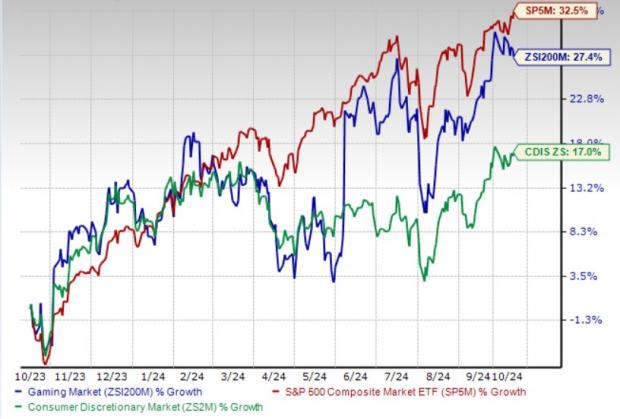

Despite the industry’s positive outlook, gaming stocks have underperformed compared to the S&P 500 and the broader Zacks Consumer Discretionary sector over the past year. However, with a forward 12-month EV/EBITDA ratio of 11.93, the industry is trading at a discount compared to the broader market.

Top Gaming Stocks to Watch

Flutter Entertainment: With steady market share gains and a strong earnings outlook, Flutter Entertainment is a compelling investment option with recent growth and positive estimates for 2024.

DoubleDown Interactive: Benefiting from a growing social casino business and increased revenue, DoubleDown Interactive offers solid prospects with a strong market position and positive earnings estimates for 2024.

GDEV Inc: Focused on sustainable growth and player experiences, GDEV Inc. is a promising player in the gaming industry, with significant stock growth and improved earnings estimates for 2024.