After the early wave of big tech earnings reports from Tesla and Netflix, the stock market is poised at new all-time highs, especially for the S&P 500. This week, some of the biggest companies including Microsoft, Meta, Apple, and Amazon are set to release their quarterly earnings results, creating intense anticipation.

Stock Market Review

Netflix, United Rentals, and American Airlines surged after their financial releases, showcasing the continued strength of the U.S. consumer base and the wider economy. Meanwhile, Tesla has encountered some challenges, but its current trading levels may attract potential interest from Wall Street sooner rather than later.

The forthcoming Magnificent 7 reports and the broader market’s future might incite some selling pressure leading to a pullback. However, history has shown that attempting to time the market is an unpredictable game, which makes the buy-and-hold approach resilient. Investing in mega-cap tech giants such as Meta, Apple, and Amazon could offer enduring value, despite initial ease in doing so.

Meta Platforms, Inc. (META)

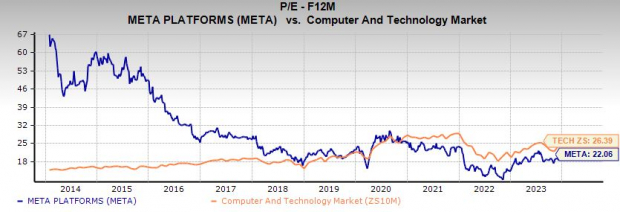

Shares of Meta Platforms, Inc. are currently trading at all-time highs ahead of its Q4 earnings release on February 1, and have soared 160% over the past year. Despite this, Meta trades at a significant discount to the Zacks tech sector, positioning itself at a 16% markdown and nearly 70% below its peak at 22.1X forward 12-month earnings. Although the stock may be slightly overextended, it is still trading above all key short-term and long-term moving averages.

Image Source: Zacks Investment Research

The parent company of Facebook, Instagram, and WhatsApp has grown its daily active user base by 7% last quarter to 3.14 billion, while its monthly active users increased by 7% to 3.96 billion. Meta’s various apps cater to different segments of social media and digital communication, positioning the company to benefit from ongoing ad spending in a world of smartphone reliance. Additionally, Meta’s investments in AI technology for the future could position it as a long-term winner if the metaverse concept becomes a reality.

Image Source: Zacks Investment Research

Meta is projected to enhance its adjusted earnings by 46% in FY23 and an additional 23% in FY24 based on 15% and 14% revenue growth, respectively. These positive earnings projections have awarded Meta Platforms, Inc. with a Zacks Rank #2 (Buy).

Amazon (AMZN)

Amazon is prioritizing efficiency and profitability and is scheduled to report its earnings on February 1. The company is working on enhancing AWS cloud computing margins through internal chip development and collaboration with Nvidia. Alongside this, Amazon is focusing on improving profitability within its e-commerce sphere by restructuring its fulfillment network. Additionally, Amazon is bolstering its digital advertising unit and aiming to attract more Prime subscribers through various streaming services and other beneficial offerings.

Image Source: Zacks Investment Research

Amazon’s earnings potential has improved, earning it a Zacks Rank #2 (Buy) with estimates projecting a 280% growth in adjusted earnings for FY23, climbing from $0.71 per share to $2.70, and poised to expand by an additional 36% in FY24. During this period, Amazon is expected to increase its revenue by 11% and 12%, respectively, rising from $514 billion last year to $637 billion in 2024.

Image Source: Zacks Investment Research

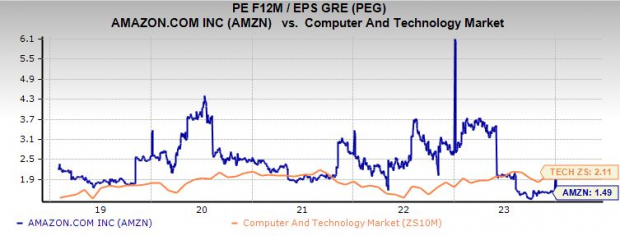

Over the last decade, Amazon’s stock has surged by 785%, significantly surpassing the Zacks Tech sector’s 280%. Despite this remarkable performance, Amazon has experienced a 2% decline in the last three years compared to the Zacks Tech sector’s 27% increase, offering an opportunity to buy at a 15% discount below its all-time highs. While Amazon’s forward earnings multiple remains high, its intensified focus on bottom-line growth positions it favorably for the future. The PEG ratio also signals the potential for Amazon’s P/E ratio to continue to decline.

The PEG ratio, a metric for determining a stock’s value while accounting for its earnings growth, and the P/E ratio suggest Amazon’s eventual downturn. Despite propelling the e-commerce sector, the heavy reliance on the company eventually invites stagnation and, as seen in previous cases, possible downfall. Presently, Amazon trades well below its all-time highs, posing an opportunity for future gain. With an amplified focus on bottom-line growth, Amazon is evidently evolving into an enticing prospect.