Even though market capitalization shouldn’t influence a company’s growth, the milestone of reaching a trillion-dollar market cap has become a symbol of prestige and success since Apple first achieved this feat in 2018. The market has pushed more companies toward this threshold, changing the way they are viewed once they achieve it. It’s akin to a corporation’s status and stature getting an immense uplift.

With this backdrop, here’s a closer look at three potential high-growth stocks that might reach market capitalizations of $1 trillion within the next decade, or even sooner. This expected market cap surge translates to a significant opportunity for interested investors.

The Potential of Advanced Micro Devices

Most individuals familiar with the hardware segment of the technology sector are likely aware of Nvidia’s pivotal role in several industry evolutions. Nvidia’s technology has had a dominating presence, from the release of its GeForce 256 graphics card in 1999 to its subsequent prominence in cryptocurrency mining and artificial hardware computing.

Nonetheless, there has been a consistent runner-up trailing in Nvidia’s path for quite some time — Advanced Micro Devices (NASDAQ: AMD). While AMD is not a direct competitor to Nvidia by many measures, the recent underpinnings of Nvidia’s growth are finally starting to favor Advanced Micro Devices. Notably, AMD is now producing high-performance, purpose-built artificial intelligence processors, which are being chosen by major companies such as Meta Platforms and Microsoft for their AI efforts.

AMD’s ability to capture even a fraction of the rapidly growing artificial intelligence hardware market, which is projected by Precedence Research to expand from approximately $600 million to nearly $2.6 trillion by 2032, could propel its shares significantly higher from their current trading levels.

Potential of Visa’s Growth

Visa (NYSE: V), the world’s largest credit card middleman, processes over 270 billion transactions annually amounting to roughly $15 trillion. With more than 4 billion cardholders utilizing their Visa cards at over 130 million locations worldwide, Visa’s ubiquitous presence is nothing short of remarkable.

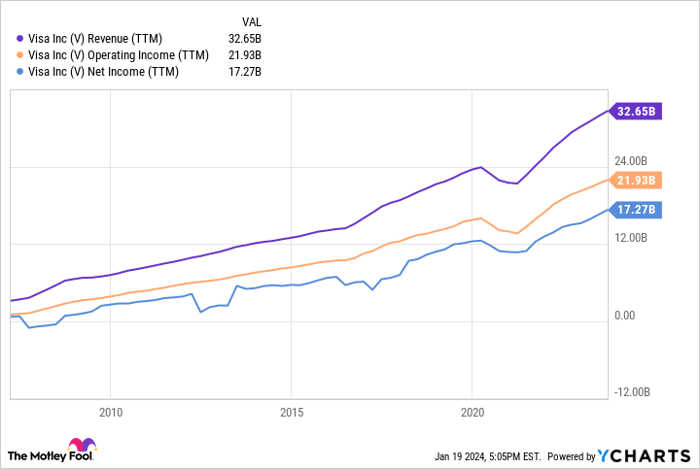

However, Visa’s relentless forward progress is what could propel the company’s market cap to $1 trillion. Except for the impact of the pandemic in 2020, Visa has consistently exhibited year-over-year profit growth since 2010, making it stand out in terms of continuous growth.

The pervasive use of credit cards in mundane transactions, as opposed to just high-value purchases, has contributed to Visa’s success. Cash transactions in the United States have reduced significantly from 40% a decade ago to just 17% now, with cards accounting for 60% of payments. These trends bode well for Visa, as cards are increasingly becoming the preferred mode of payment, leaving a substantial portion of commerce ripe for exploiting.

With Visa’s current market capitalization already over $500 billion, considering its momentum, there is a strong possibility it could cross the trillion-dollar mark within a decade or less.

The Growth Trajectory of PDD Holdings

Lastly, PDD Holdings (NASDAQ: PDD) is another high-growth stock with the potential to emerge as a trillion-dollar powerhouse in the next 10 years.

PDD Holdings is the company behind Temu, the international version of China’s

The Meteoric Rise of PDD Holdings: A Paradigm Shift in E-commerce

The Unlikely Genesis

In the high-stakes world of e-commerce, where giants such as Amazon and Alibaba reign supreme, an unlikely contender has emerged from the heart of China. Pinduoduo, conceived as a platform for connecting local farmers directly with consumers, has transcended its original purpose and now stands at the forefront of online retailing in China.

Disrupting the Status Quo

Pinduoduo’s model is causing a stir in the retailing business by upending the traditional wholesale model and giving manufacturers a direct line to shoppers. This approach has not only seen staggering success but has also redefined the rules of engagement in the e-commerce landscape.

Financial Triumph

The company’s third-quarter revenue saw a momentous upsurge of 94% year over year, propelling its operating profit to a 60% increase. These remarkable figures do not merely sustain the growth trend but propel it forward with unmistakable fervor. Financial analysts are painting an equally vivid picture, with a projected revenue three times the size within the next five years and the potential for an exponential rise in a decade.

The Uphill Climb

PDD Holdings may still be a ways off from the coveted $1 trillion market, sitting at a valuation a shade under $200 billion. Nevertheless, it stands as the frontrunner in terms of rapid growth and the promise of future expansion. While it presents an above-average risk, the potential for reward is equally exceptional.

The Verdict

Perhaps the most pressing question on investors’ minds is whether to take the plunge and invest in PDD Holdings. However, wisdom dictates thorough consideration before making such a weighty decision. While some may laud the company’s ascent, others, such as Motley Fool Stock Advisor, offer a different perspective, singling out different stocks for potential meteoric returns in the approaching years.

It is incontrovertible that the rise of PDD Holdings bears watching, not only for investors but also for industry players, as it continues to redefine the very fabric of e-commerce.

*Stock Advisor returns as of January 16, 2024