The Zacks Finance sector is abuzz as 73% of companies have surpassed their quarterly earnings targets, spearheaded by powerhouses such as JPMorgan (JPM), Citigroup (C), and other major banks. With JPMorgan and Citigroup setting a positive tone for the first quarter earnings season in the financial world, the stock market witnessed an upsurge. Furthermore, key finance stocks are making waves ahead of their Q1 reports on Monday, April 22, potentially offering a prime buying opportunity.

Opportunity in Brown & Brown: A Steady Ship

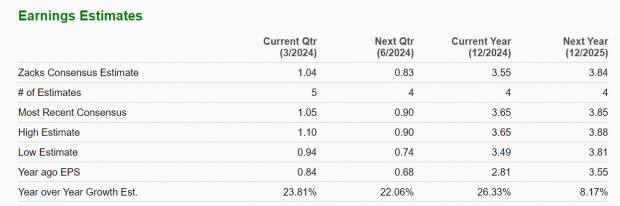

Brown & Brown, known for its diverse insurance portfolio and strong presence in the United States, London, Bermuda, and the Cayman Islands, is a promising prospect. Projections indicate a 24% increase in Q1 EPS to $1.04 from the previous year’s $0.84 per share. The company expects quarterly sales to escalate by 8% to $1.21 billion, with a robust 26% surge in annual earnings forecasted for fiscal 2024, reaching $3.55 per share. Additionally, an 8% growth in EPS is anticipated for the next year, coupled with high single-digit revenue growth for FY24 and FY25. The sails are set for Brown & Brown to navigate prosperous waters in the near future.

Equity Lifestyle Properties: Riding the Wave of Growth

Equity Lifestyle Properties, a notable Real Estate Investment Trust (REIT), manages a self-managed portfolio encompassing home sales, rental operations, and recreational facilities. Anticipated Q1 earnings spell a 4% upturn to $0.77 per share, with sales expected to climb 5% to $389.49 million. Looking ahead, the company foresees a 5% EPS growth in FY24 and a subsequent 6% rise reaching $3.08 per share in FY25. Equity Lifestyle’s upward trajectory extends to total sales, poised for single-digit escalation in FY24 and FY25, appealing to income-oriented investors with its 3.06% annual dividend hike over the past five years.

Globe Life: Illuminating Potential in Insurance Sector

Globe Life, an insurance holding firm, shines bright with forecasts predicting a 10% spike in Q1 EPS to $2.80 per share, alongside a 5% surge in sales to $1.43 billion. The company’s robust subsidiaries cater to life and supplemental health insurance for middle-income households across the U.S. Looking ahead, Globe Life envisions an 8% growth in EPS for FY24 and FY25, with an estimated 5% rise in total sales this year and a further 4% increase to $6.1 billion by FY25. Currently undervalued with a 5.6X forward earnings multiple, Globe Life presents a lucrative opportunity coupled with a 1.48% annual dividend yield.

Final Thoughts on Finance Stocks

With Brown & Brown, Equity Lifestyle Properties, and Globe Life showing robust growth in Q1, these finance stocks are certainly on the radar for investors. Holding a Zacks Rank #2 (Buy), these companies could witness further stock upticks in the upcoming week if they validate their promising outlook.

Zacks Names “Single Best Pick to Double”

From a vast array of stocks, Zacks experts have pinpointed their top choices for potential gains exceeding 100% in the coming months. Led by Director of Research Sheraz Mian, a lesser-known chemical entity emerges as a standout performer, with a remarkable 65% growth over the past year, primed for considerable expansion with surging 2022 earnings estimates and substantial share repurchases. This opportunity mirrors or even surpasses previous Zacks’ success stories such as Boston Beer Company and NVIDIA, showcasing the immense growth potential in the current market scenario.