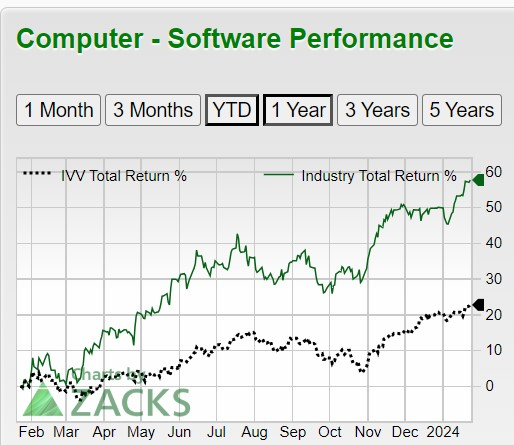

Many computer software companies have contributed to the Nasdaq’s impressive performance over the past year.

The Zacks Computer-Software Industry’s one-year return is +58%, outpacing the S&P 500’s +21% and the Nasdaq’s +36%.

The outlook for top-rated computer software stocks has become very intriguing, driven by the prospects of easing inflation and lower interest rates, which bode well for consumer spending on tech products.

Here are three expansive software companies that could see their stocks rise even more in 2024.

Blackbaud: Leading the Charge

Image Source: Zacks Investment Research

Blackbaud BLKB

Blackbaud, with a Zacks Rank #1 (Strong Buy), offers a full spectrum of cloud-based and on-premise software solutions. The company provides leading software solutions for social causes, combining technology and expertise to help organizations achieve their missions.

Steady top-line growth and expansive profitability have pushed Blackbaud’s stock up +35% over the last year. The company is expected to round out its fiscal 2023 with earnings up 43% to $3.86 per share versus $2.69 a share in 2022. More impressive, FY24 EPS is projected to expand another 17% with total sales anticipated to rise to $1.2 billion.

Further reassuring investors is that Blackbaud has surpassed earnings expectations for six consecutive quarters, and is expected to exceed expectations in its upcoming fourth-quarter report scheduled for February 12.

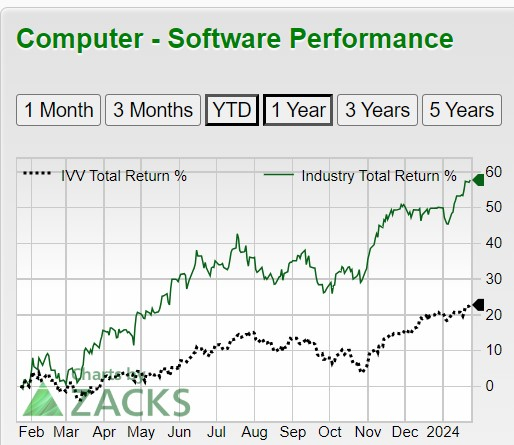

Microsoft: A Long-term Powerhouse

Image Source: Zacks Investment Research

Microsoft MSFT

Microsoft, with a Zacks Rank #2 (Buy), has seen its stock climb +64% in the last year, outpacing the Zacks Computer-Software Industry’s performance.

Over the past five years, Microsoft’s stock has surged +273%, and it has almost climbed 1000% in the last decade, comfortably eclipsing the performance of the broader indexes and the Zacks Computer-Software Markets’ growth.

Microsoft’s growth has been fueled by enterprise-to-consumer software solutions, leading cloud capabilities through Microsoft Azure, and strategic acquisitions including LinkedIn, Skype, and most recently, Activision Blizzard. With artificial intelligence driving Microsoft’s software capabilities, the company is expected to post double-digit percentage growth on its top and bottom lines in FY24 and FY25.

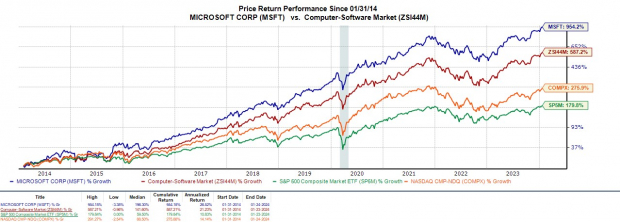

Trend Micro: Catching Up Strong

Image Source: Zacks Investment Research

Trend Micro TMICY

Trend Micro, with a Zacks Rank #1 (Strong Buy) and an “A” Zacks Style Scores grade for Momentum, has gained relevance due to its endpoint and Web security software and services.

The company’s stock has risen +15% over the last year and an impressive +52% in the last three months, with fiscal 2024 EPS estimates climbing 20% in the last 30 days. FY24 EPS projections would represent a sharp rebound and 86% growth from end-of-the-year projections for FY23.

Boosting Trend Micro’s bottom line recovery is steady top-line growth as total sales

Trend Micro Inc. Sees Positive Growth for FY23 and FY24

After a tumultuous year for many industries, the forecast for Trend Micro Inc. is looking brighter as the company is projected to experience a 3% increase in FY23, followed by a substantial 9% surge in FY24 to reach $1.93 billion. The upcoming Q4 results for fiscal 2023, set to be reported on February 15, are expected to play a significant role in shaping market sentiments for the company. If the results are accompanied by positive guidance reaffirming the company’s robust FY24 outlook, it could fuel a sustained market rally.

Image Source: Zacks Investment Research

Assessment of Zacks Computer-Software Industry

Amidst this anticipated growth for Trend Micro, the Zacks Computer-Software Industry maintains a strong position in the top 40 percentile among over 250 Zacks industries. Notably, Blackbaud, Microsoft, and Trend Micro stand out as focal points for those closely monitoring the industry and seeking potential investment opportunities.