The conclusion of the 2024 Q2 earnings season has brought forth a chorus of successes, with numerous companies reveling in enhanced profitability amidst swelling margins. Notable among these triumphant entities are Deckers Outdoor (DECK), Kimberly Clark (KMB), and the retail behemoth Walmart (WMT). Let us delve into the intricacies of each recent quarterly disclosure to illuminate their financial prowess.

Deckers Outdoor Sailing on Brand Momentum

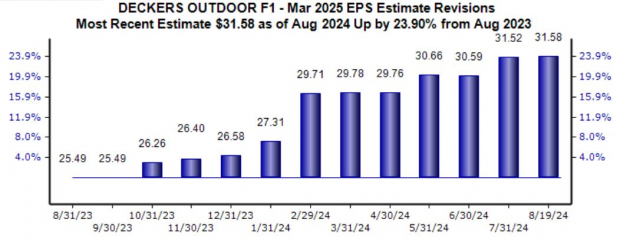

A consistent performer, Deckers Outdoor has once again surged past expectations, propelled by both earnings and revenue surpluses. With EPS flaunting a monumental 90% annual growth and revenue escalating by 22% from the previous year, the company has witnessed a flourishing ride. The surge is primarily credited to sustained brand traction of UGG and Hoka shoes, compelling Deckers Outdoor to revise its fiscal year forecast upwards. Analysts have followed suit by adjusting their projections, forecasting an 8% year-over-year EPS hike to $31.58.

Image Source: Zacks Investment Research

Moreover, Deckers Outdoor’s profit margins have undergone a delightful expansion, pushing its profitability narrative to new zeniths. The latest earnings reveal a formidable gross margin rise from 51.3% to 56.9%, exemplifying the company’s relentless pursuit of financial excellence.

Note: The chart below presents data on a trailing twelve-month basis.

Image Source: Zacks Investment Research

Kimberly-Clark’s Defensive Strength Shines Through

Kimberly-Clark (KMB) emerges as a steadfast performer, with its shares soaring by over 15% year-to-date. Positioned within the resilient consumer staples sector, the company’s products possess an inherent quality of driving steady demand, irrespective of the economic backdrop. Bolstered by a Zacks Rank #2 (Buy), Kimberly-Clark has witnessed an upward trajectory in earnings predictions for the ongoing fiscal year following an optimistic guidance revision.

Image Source: Zacks Investment Research

The company’s robust cost management strategies have significantly boosted its profitability, with the latest quarterly adjusted EPS witnessing a remarkable 20% surge year-over-year. Margin expansion has further buoyed investor sentiments, as illustrated in the graph below.

Please note that the chart below reflects data on a trailing twelve-month basis.

Image Source: Zacks Investment Research

Walmart’s Profit Surge Beckons Attention

Behemoth retailer Walmart (WMT) stands tall with a remarkable 22% surge in EPS and a nearly 5% uptick in sales, outstripping market estimates in both aspects. The retail juggernaut has displayed an all-round stellar performance, witnessing a 43 basis points enhancement in gross margin and a boost in operating income. Noteworthy is the escalating prominence of eCommerce, which has unfailingly lent tailwinds across all segments during the period under review.

Behold a chart depicting the company’s gross margin trends on a trailing twelve-month basis.

Image Source: Zacks Investment Research

Walmart’s digital initiatives have emerged as a formidable growth engine, consistently delivering robust results in recent cycles. Global eCommerce sales have surged by a commendable 21%, with an increasing number of consumers opting for convenient pickup and delivery services. Post-earnings, Walmart uplifted its FY25 net sales and adjusted operating income forecasts, a move well-received by the market. Analysts, in response, have realigned their earnings expectations, culminating in a projected 10% increase in EPS to $2.44 for the upcoming fiscal year.

Image Source: Zacks Investment Research

In Summary

The triad of Deckers Outdoor (DECK), Kimberly Clark (KMB), and Walmart (WMT) have each authored remarkable quarterly narratives, amplified by the expansion of profit margins across their distinctive spheres of influence. As they navigate the tempestuous waters of the market, these companies continue to impress investors with their resounding financial performances.