Consumers wield immense power in the U.S. economy, and companies catering to their whims have the potential to thrive for decades, becoming veritable juggernauts in the process. Among these stalwarts stand out Apple, The Home Depot, and Costco Wholesale – each representing a jewel in the crown of consumer-facing businesses.

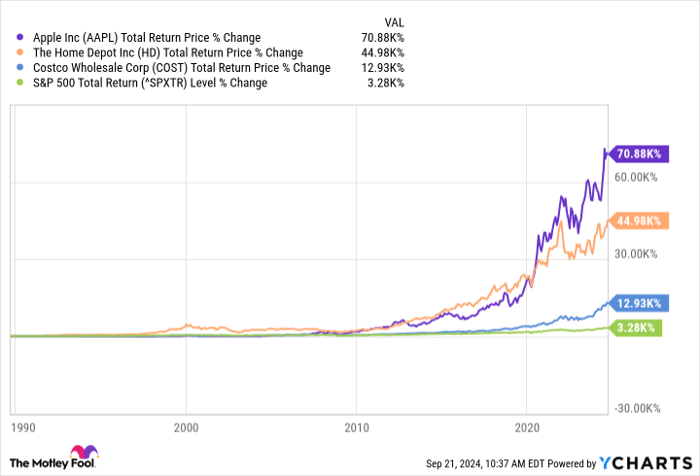

These market darlings have demonstrated their mettle by outperforming the S&P 500 consistently over the years. Their enduring success on Wall Street is no secret, but their premium price tags often deter bargain hunters, especially amidst record-high market levels.

However, should the market undergo a significant correction or a full-blown crash, these blue-chip stocks could prove to be irresistible bargains for savvy investors.

Apple: The Tech Titan

In today’s world, it seems iPhones are as ubiquitous as air itself, a testament to Apple’s domination in the personal electronics realm. Boasting staggering annual revenues nearing $400 billion, with over $100 billion in free cash flow, Apple stands as one of the largest corporations globally, commanding awe-inspiring financial metrics.

While its growth trajectory may have plateaued, Apple’s robust cash generation allows it to fuel investor returns through aggressive stock buyback initiatives and a steadily burgeoning dividend. Analysts foresee an approximately 12% annual earnings growth for Apple in the long run, paving the way for substantial wealth accumulation over the years.

Despite its blue-chip allure, Apple currently sports a lofty price-to-earnings ratio of 34, a valuation that even seasoned investor Warren Buffett has found challenging to justify. Patient investors eyeing Apple should wait for a more reasonable entry point, ideally when its P/E retreats to the mid-20s or lower, aligning more closely with its growth prospects.

Home Depot: The DIY Giant

With approximately 144 million U.S. households perpetually in need of home improvement essentials, the home improvement market stands as a lucrative arena for Home Depot, with its colossal $152 billion in annual sales. Boasting a stellar 31% return on invested capital and top-notch management, Home Depot reigns supreme in this sector.

Efficient revenue expansion serves as a potent catalyst for investment growth, with substantial room for further market penetration. Projections suggest that the U.S. home improvement industry could surpass $600 billion by 2027.

Despite these promising growth prospects, Home Depot’s elevated valuation, with a current P/E of 26, poses a hurdle for investors seeking optimal returns. To maximize potential gains, buyers should target an entry point when the stock’s P/E retreats to the low 20s, representing a discount of approximately 20% from current levels.

Costco Wholesale: The Retail Dynamo

Costco commands a rare and dedicated following among consumers, synonymous with its legendary $1.50 hotdog combo. Despite raking in a whopping revenue exceeding $253 billion annually, Costco’s modus operandi of selling bulk goods at razor-thin margins has propelled its success to stratospheric heights.

Notably, the bulk of Costco’s profits stem from membership fees, a strategic lever facilitating earnings growth. Recently, the company hiked its membership fee for the first time in years, a move poised to bolster its financial performance.

Eschewing traditional advertising expenses, Costco opts for rewarding shareholders with regular dividends and occasional special dividends, signaling a shareholder-friendly ethos. However, despite its sterling reputation and robust financials, Costco’s stock price commands a premium, currently trading at 51 times its estimated 2024 earnings, significantly above its historical average P/E of 35.

Analysts anticipate Costco’s earnings to compound at just over 9% annually over the long term, underscoring steady but perhaps unexceptional growth prospects. To align investor returns with intrinsic value, prudent buyers should wait for a discount, ideally purchasing Costco shares when the P/E ratio retreats to more palatable levels.

Unlocking Apple’s Fortunes: A Deep Dive into Investment Potential

Apple, with a beta of 0.8, boasts stability rather than volatility, indicating that significant market fluctuations would be required to impact its valuation significantly. Current purchase levels carry the potential for years of static or adverse returns.

Assessing Investment Opportunities in Apple

Before considering an investment in Apple, it is crucial to note the insights presented by the Motley Fool Stock Advisor analysts. The team has discerned what they deem to be the prime stocks for investors presently, with Apple not making the cut. The ten selected stocks hold the promise of substantial returns in the foreseeable future.

Considering the example of Nvidia, which was identified on April 15, 2005: those who had invested $1,000 following this recommendation would now enjoy $712,454!*

The Stock Advisor service offers investors a clear roadmap to success, covering diverse aspects such as portfolio development, regular analyst updates, and two novel stock suggestions monthly. Since its inception in 2002, the Stock Advisor service has significantly surpassed the returns of the S&P 500, more than quadrupling its performance*.

Explore the top 10 stock picks

*Stock Advisor returns accurate as of September 23, 2024

Disclaimer: No positions held in any stocks mentioned by the author. The Motley Fool endorses and holds positions in Apple, Berkshire Hathaway, Costco Wholesale, and Home Depot. The Motley Fool operates with a strict adherence to its disclosure guidelines.