The auto industry is a hub of constant activity, with new vehicles sales soaring as inventory levels normalize post-pandemic. This uptick in new vehicle purchases is causing a ripple effect, with used vehicle prices and sales taking a hit. Additionally, there has been a shift in consumer preference towards gas-electric hybrid models, away from electric vehicles, prompting automakers to swiftly adapt their strategies.

Ford Motor (F)

Ford Motor (NYSE: F) has shown remarkable resilience following challenges like the UAW strike last fall. The Detroit-based automotive behemoth surprised markets with a robust first-quarter profit, driven by strong sales of its commercial vehicles. Despite a minor revenue miss, Ford reported earnings per share of 49 cents, surpassing the 42 cents anticipated by analysts. Moreover, Ford’s decision to pay a special dividend of 18 cents per share, on top of its regular quarterly distribution of 15 cents a share, showcases its commitment to shareholders. Trading at just 12 times future earnings estimates, Ford stock, currently down 3% for the year, presents an enticing investment opportunity.

Honda Motor (HMC)

Turning to Japan, Honda Motor (NYSE: HMC) stands out as a key player in the automotive space. Renowned for its Civic sedans and Odyssey minivans, Honda also holds the title of the world’s largest motorcycle manufacturer since 1959. Honda reported a 70% surge in net profit, fueled by a spike in vehicle sales, particularly in its hybrid models. With an annual profit of $7 billion and a 21% increase in sales, Honda’s strategic focus on hybrid vehicles is paying off, especially in regions like the U.S., Canada, and Europe. Trading at a mere 7 times future earnings forecasts, and offering a substantial quarterly dividend of 44 cents with a 5.6% yield, Honda stock appears undervalued and ripe for investment.

General Motors (GM)

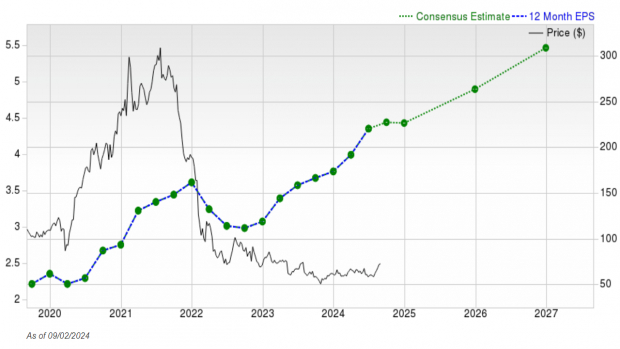

General Motors (NYSE: GM) has been executing a robust strategy to bolster its stock price, and the results are evident. With a remarkable 32% increase in stock value so far in 2024, GM has outperformed most other auto stocks. The company’s strong performance is attributed to stellar earnings and proactive measures, including a new $6 billion stock buyback program. GM raised its 2024 guidance after beating Q1 earnings expectations, reporting EPS of $2.62 versus the anticipated $2.15, and revenue of $43.01 billion compared to the estimated $41.92 billion. Upheld by solid North American sales, particularly in the pickup truck segment, GM’s optimistic outlook underscores its position as a key player in the industry.