Venture into the realm of artificial intelligence (AI) stocks beyond the shadow of Nvidia and discover a diverse array of investment opportunities awaiting you. From chips to software, various sectors are primed to benefit from the upward trajectory of AI in the years to come.

By aligning your investments with standout performers, those capable of maintaining a competitive edge as the AI landscape expands and transforms, you position yourself for enduring success. Recently, three astute minds on Fool.com identified Amazon (NASDAQ: AMZN), Qualcomm (NASDAQ: QCOM), and Meta Platforms (NASDAQ: META) as top contenders. These companies not only possess the necessary tools for sustained success but also offer their stocks for a mere $1,000.

Amazon: A Gem in the Rough

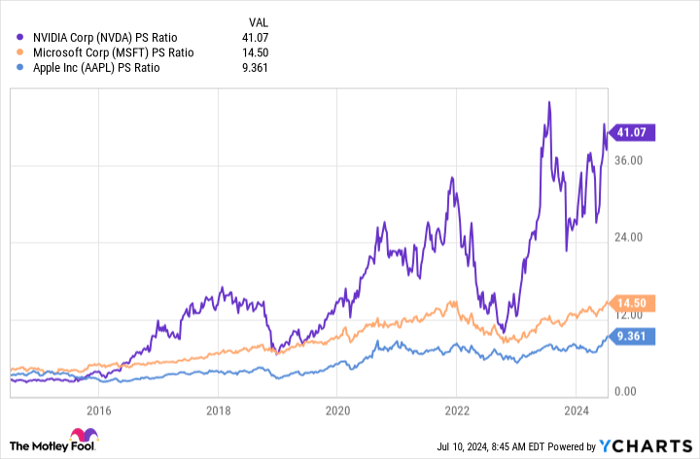

Jake Lerch, a Fool contributor, advocates for the procurement of Amazon shares, citing its modest valuation as a compelling factor. Amidst the tumultuous journey of AI stocks, with some reaching perilously high valuation levels, Amazon stands out as a beacon of stability. The price-to-sales (P/S) ratio, a critical metric reflecting market sentiments and growth expectations, reveals that while industry giants like Apple, Microsoft, and Nvidia soar to decade-high ratios, Amazon harbors a modest P/S ratio of 3.6x in comparison to Nvidia’s towering 41.8x. This anomaly signifies Amazon’s enduring appeal in an era of inflated valuations. Bolstered by a multitude of AI ventures spanning from smart speakers to a fleet of humanoid robots, Amazon’s financial robustness positions it favorably to thrive in the AI revolution, propelling the stock to potentially great heights.

In essence, investors seeking an AI stock for eternal holding should look no further than Amazon.

Qualcomm: Forging Connections Through Innovation

Will Healy, in his endorsement of Qualcomm, highlights the company’s pivotal role in the AI chipset domain. While Nvidia assumes a dominant stance, Qualcomm is emerging as a formidable player, particularly due to its emphasis on on-device AI. This strategic approach harmonizes cloud AI with edge devices, culminating in swift and efficient delivery of AI capabilities. Moreover, Qualcomm’s foray into IoT devices, automotive platforms, and PC chips underscores its endeavor to cultivate a tech ecosystem steered by AI. After experiencing a revenue slump in fiscal 2023, Qualcomm has staged a remarkable rebound in fiscal 2024, characterized by a 3% revenue upsurge and robust net income figures. With a revenue growth rate on the cusp of transitioning to double digits, Qualcomm’s trajectory appears poised for substantial expansion, beckoning investors to partake in its promising journey.

The spotlight is undoubtedly shining on Qualcomm,

An Insightful Analysis of AI Stocks in the Market

The stock has ascended by nearly 80% in the past year, propelling its P/E ratio to approximately 28, its loftiest level in over three years.

If double-digit revenue growth resumes, the uptick in profits is poised to mitigate the effects of its burgeoning valuation. Over time, enhanced financial performance, combined with Qualcomm’s expanding relevance in the AI sector, is anticipated to reinforce its status as a lucrative long-term investment.

Meta Platforms: Harnessing AI in Harmony

Justin Pope (Meta Platforms): Meta Platforms emerged as a top contender on my quest for the premier buy-and-hold AI stock. The rationale behind investing in Meta stock is both straightforward and impactful. The corporation presently stands as a formidable technological powerhouse, generating revenue from digital ads targeted at its 3.24 billion daily active users across social media platforms like Facebook, Instagram, WhatsApp, and Threads.

This venture has proven to be lucrative; Meta translates a robust 35% of its revenue into free cash flow and achieves an impressive 29% return on invested capital.

Despite its $1.3 trillion market cap, Meta continues to offer substantial growth potential. Analysts foresee an average annual earnings growth rate of 18% for the company in the long run, with AI expected to play a pivotal role in driving this expansion. Meta has strategically deployed AI to enhance its advertising operations and bolster profitability.

Furthermore, Meta has made significant investments in AI infrastructure, channeling billions of dollars into the development and operation of generative AI models.

Moreover, the beauty of Meta lies in its independence from AI as a make-or-break factor for its stock. While AI has the potential to unlock the growth necessary for Meta to maintain its position as a long-term market outperformer, the company exhibited strong performance even before integrating AI. With Mark Zuckerberg, Meta’s CEO and co-founder, at the helm and a youthful age of just 40, investors can rest assured that the company is well-positioned for sustained success in the foreseeable future.

Ultimately, with a P/E ratio of 26 times earnings, Meta’s stock remains appealing, presenting a reasonable valuation for a business that is forecasted to grow earnings by 18% annually. In comparison to other overpriced AI stocks, Meta stands out as a potential standout performer should it realize its full AI capabilities.

These factors collectively underscore Meta as an unequivocal choice for investors seeking exposure to the burgeoning AI sector.

Is Amazon a Wise Investment Decision at Present?

Prior to delving into Amazon stock, it is prudent to consider the following:

The analyst team at Motley Fool Stock Advisor recently pinpointed what they believe to be the 10 best stocks for investors to acquire presently, with Amazon not making the list. The selected stocks are anticipated to yield significant returns in the years ahead.

Reflect on the inclusion of Nvidia in a similar list back on April 15, 2005 – an investment of $1,000 at the time of recommendation would have burgeoned to $791,929!

By providing investors with a user-friendly roadmap to success, inclusive of portfolio construction guidance, regular analyst updates, and two fresh stock picks each month, the Stock Advisor service has significantly surpassed the return of the S&P 500 since 2002.

Curious to explore the 10 recommended stocks? Check them out here »

*Stock Advisor returns as of July 8, 2024