Golden Cross Event Signals Bright Future

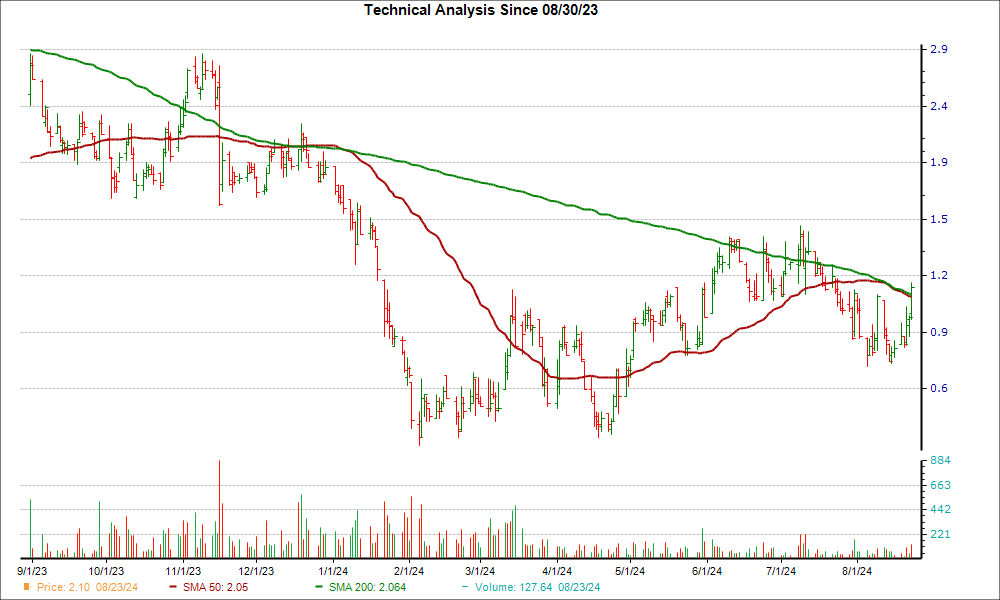

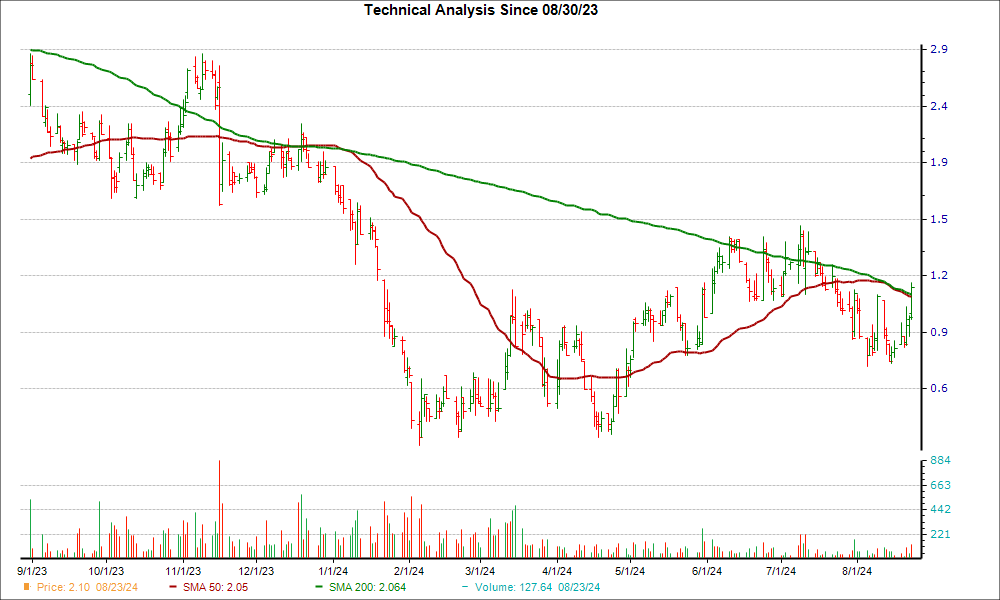

From a technical viewpoint, Vnet Group Inc. (VNET) has caught the attention of investors as it recently hit a crucial support level. The golden cross, where the 50-day simple moving average surpasses the 200-day simple moving average, has been achieved by VNET.

Known as a significant indicator for a bullish breakout, the golden cross is a key technical chart pattern that materializes when a stock’s short-term moving average crosses above its long-term moving average. Typically, the 50-day and 200-day moving averages are involved in this crossover, as longer timeframes often result in more robust breakouts.

This chart pattern unfolds in three stages. It kicks off when a stock’s declining price reaches a bottom. Next, the shorter moving average surpasses the longer moving average, signaling a positive trend reversal. The third and final stage involves the stock sustaining its upward trajectory.

Positive Signs for VNET

The golden cross signifies a bullish sentiment, contrary to the death cross, an event that anticipates bearish price movement in the future.

With VNET climbing 25.3% in the past four weeks, the company seems poised for a potential breakout. Additionally, VNET currently holds a #2 (Buy) on the Zacks Rank scale.

Scrutinizing VNET’s earnings projections further strengthens the case for its bullish trend. In the ongoing quarter, there has been a notable increase in upward revisions compared to downward revisions over the last 60 days, with the Zacks Consensus Estimate also seeing an upward shift.

Potential Gains Ahead

Considering the positive movement in earnings estimates coupled with the optimistic technical signal of the golden cross, investors are advised to keep a close watch on VNET as it may herald further gains in the near future.

Update: The mentioned article was originally published on Zacks.com