Many things will change between now and 2030. The wisdom of Warren Buffett, arguably the greatest investor of all time, won’t be one of them. Buffett’s timeless investing advice tells us to try finding businesses to invest in, not to make a quick profit, but to hold on to them for a long time, ideally forever.

Thankfully, we can also peek into Buffett and his team’s stock picks to help guide our own. And in that spirit, let’s consider two Warren Buffett stocks that could deliver above-average returns through 2030: Amazon (NASDAQ: AMZN) and Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B).

1. Amazon

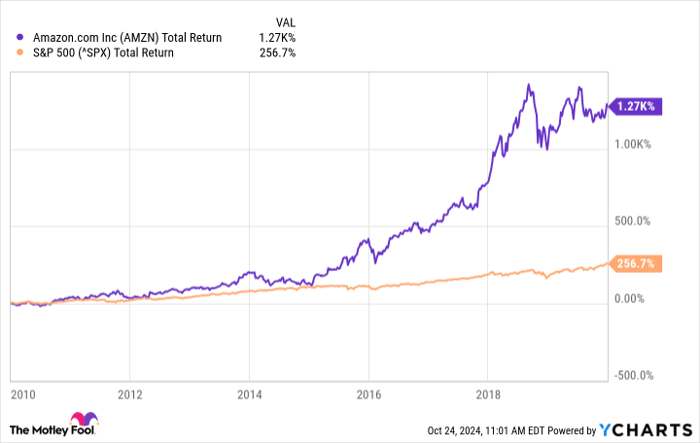

Amazon crushed the market in the 2010s, a decade characterized by historically low interest rates that likely helped spur equities — especially growth-oriented stocks — thanks to cheaper borrowing and higher consumer spending.

AMZN Total Return Level data by YCharts.

Interest rates have risen substantially in recent years and remain well above their 2010s level, something that usually pushes investors toward safer, more disciplined companies that generate steady revenues and profits.

That describes Amazon well. The e-commerce specialist is a leader in practically every major industry in which it has a hand. The company’s e-commerce platform is one of the most visited websites in the world, which also helps fuel its advertising business. Its Amazon Web Services (AWS) holds a top market share in the cloud-computing industry.

Amazon is also a major player in other markets, such as video and music streaming. As a result, the tech company generates steady and growing revenue and profits. Further, Amazon is looking to impose itself in the fast-growing artificial intelligence (AI) field. The company offers a suite of AI-related services through AWS. Amazon’s services include Amazon Q, an AI-powered assistant; Amazon Polly, an application that helps turn text to speech; Amazon Bedrock, designed to help develop large language models, and more.

According to management, the company’s AI business already boasts a multibillion-dollar run rate, and it is still in its early innings. I expect Amazon’s AI business — and the totality of its cloud computing unit — to provide an important tailwind through 2030. The company’s position in these markets should be safe for a long time since it benefits from high switching costs.

Amazon will likely continue pursuing various growth opportunities, just as it has in the past. Steady profits and excellent growth prospects could add up to market-beating returns for Amazon through the end of the decade.

2. Berkshire Hathaway

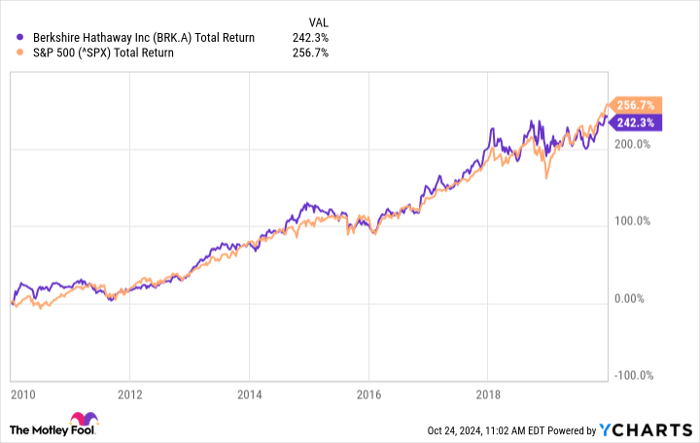

The Warren Buffett-led conglomerate Berkshire Hathaway underperformed the S&P 500 index’s total returns in the 2010s, but only barely.

BRK.A Total Return Level data by YCharts.

It still stands as one of Buffett’s favorite stocks, as evidenced by the fact that he has been buying back shares of his own company quite a bit in recent years, even as he cut his stake in some of his other favorite stocks such as Apple.

What gives Berkshire Hathaway the ability to outperform the market through 2030?

One challenge in beating the S&P 500 is that the index is a diversified mix of companies across many industries. While some might perform well, others won’t. But the overall performance is such that it smooths out stock market losses.

No single company is that diversified, but few get as close as Berkshire Hathaway. The company owns various major corporations across several sectors. Insurance giant Geico might be one of its most famous subsidiaries, but it has several others, including Duracell and the apparel company Fruit of the Loom.

Berkshire Hathaway’s diversification and consistently strong financial results make it an excellent stock even before we consider its greatest weapon. Each of the constituent companies in the Berkshire portfolio are added after thorough, thoughtful research, and meets Buffett’s stringent investment criteria. This approach helps Berkshire have a diversified set of winners that makes it a far superior portfolio than a 500-company index fund.

What makes the Berkshire portfolio more potent is the availability of substantial capital at disposal. Buffett and his team’s strategy to keep a significant amount of dry powder handy is probably its greatest weapon. They can deploy this money for future investing when they feel stocks are trading cheaply, versus their intrinsic value.

Though Buffett is in his 90s, his successor has already been chosen: Greg Abel, the current CEO of Berkshire Hathaway Energy. With or without Buffett, expect Berkshire Hathaway to continue doing those things that have made the company so successful over the long run.

And in this more challenging economic environment, it is precisely the kind of stock many investors will gravitate toward. That’s why Berkshire Hathaway could beat the market through 2030.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,706!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,529!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $406,486!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 28, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Prosper Junior Bakiny has positions in Amazon. The Motley Fool has positions in and recommends Amazon, Apple, and Berkshire Hathaway. The Motley Fool has a disclosure policy.