Shifting Trends in Business Services

The business services sector is starting to stand out among the Zacks Rank #1 (Strong Buy) list with 19 stocks in the space receiving strong buy ratings.

Amidst this, the Zacks Technology Services Industry, residing in the top 30% of roughly 250 Zacks industries, shines brightly. At this juncture, attention is drawn to two budding giants in technology services, having recently debuted their Initial Public Offerings (IPOs).

Revolutionizing Finance: Sofi Technologies

One such entity is Sofi Technologies (SOFI), priced below $10, capturing the market with its consumer-centric financial domain. Stepping into the public arena in 2021, Sofi is solidifying its position as one of the most diversified fintech entities in the United States. Its ambit spans loans, credit cards, investing, insurance, and banking services.

Of significant note, Sofi stands at the brink of profitability, with fiscal 2024 earnings anticipated at $0.09 per share, in stark contrast to a loss of -$0.36 a share last year. Furthermore, expectations suggest a monumental 182% surge in FY25 EPS to $0.26.

The rapid ascent in Sofi’s top-line growth bolsters its prospective earnings, with total sales projected to escalate by 18% this year and an additional 14% in FY25 to $2.81 billion.

The Oriental Star: Qifu Technology

Another rising star is Qifu Technology (QFIN), which unveiled its IPO last year, establishing itself as a major player in Chinese fintech. As a credit tech platform, Qifu offers a holistic suite of technology services catering to financial institutions, consumers, and enterprises throughout the loan life cycle.

Impressively, Qifu’s stock has soared by approximately 60% year to date, outshining major Chinese tech behemoths like Alibaba (BABA) and Baidu (BIDU), which have observed declines of -8% and -35%, respectively.

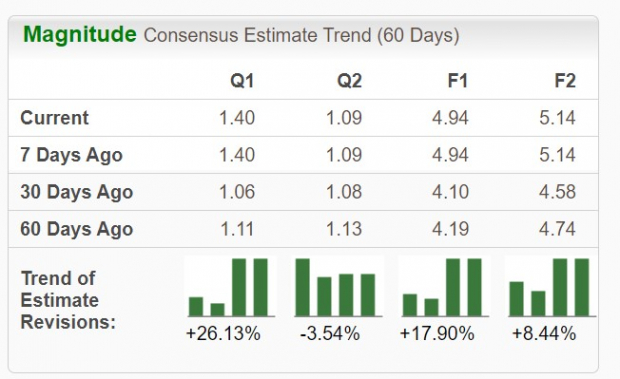

Investor fervor for Qifu is palpable, given its profitable status, with annual earnings expected to skyrocket by 34% in FY24 to $4.94 per share compared to $3.68 in 2023. Looking ahead, a 4% uptick is projected for FY25 EPS. Noteworthy is the substantial upside in Qifu’s stock, supported by a 5X forward earnings ratio, substantially lower than S&P 500’s 23.7X, Alibaba’s 8X, and Baidu’s 10.1X.

Insights and Opportunities

Similar to Qifu, Sofi has also witnessed robust revisions in earnings estimates. With their strengthening prospects, the current juncture presents an opportune moment to delve into investments in these burgeoning technology services entities, poised to evolve as lucrative options for 2024 and beyond.

Image Source: Zacks Investment Research

Bottom Line

Unveiling a substantial opportunity for growth and innovation, Sofi Technologies and Qifu Technology exemplify the changing landscape of the technology services industry. With promising growth trajectories and strengthening financial outlooks, investors are urged to consider these emerging technology giants as frontrunners in the realm of financial services.