The Magnificent Seven, originally crafted by the esteemed Mad Money host Jim Cramer, champions companies with substantial growth potential and resilience in the face of economic tumults. However, Tesla (NASDAQ:TSLA), after a disappointing quarterly performance, has been ousted from this prestigious group. This raises the critical question of which other high-growth companies are worthy of a spot in the Magnificent Seven.

The Rise and Fall of FAANG: Netflix’s Resurgence

The days of the FAANG dominance, serving as the driving force behind soaring market indices, may be etched in the memories of seasoned investors. For those who recently waded into the market within the last two years, the narrative has shifted towards the Magnificent Seven. Nonetheless, the revival of Netflix (“N” in the original FAANG) is reinstating its potential, reigniting bullish sentiments.

Netflix faced a severe downturn in late 2021 and early 2022, plummeting by approximately 75% from its peak. This free fall cast Netflix out of the conversation, marking the transition from FAANG to the Magnificent Seven era. Presently, Netflix is staging an impressive resurgence, dispelling detractors with a series of robust quarters that have propelled its stock by over 220% from its 2022 lows.

Although the streaming landscape grew increasingly competitive, and pandemic-induced champions faltered, Netflix demonstrated its resilience. The company’s exceptional content, even amidst substantial price hikes, has fostered unwavering user loyalty. Furthermore, its foray into ad-based services and gaming has reinstated its position as a growth stock.

While Netflix’s future trajectory remains uncertain, its recent performance underscores its resilience. Despite being about 18% below its 2021 peak, the stock’s multiple expansions have caused some analysts to downgrade its prospects due to valuation concerns. At 46.8 times trailing price-to-earnings (P/E), Netflix’s stock commands a premium relative to its historical average and peer group. Sustaining this growth will mandate a continuous release of top-tier content and the successful expansion of its gaming initiative.

The Price Target for NFLX Stock

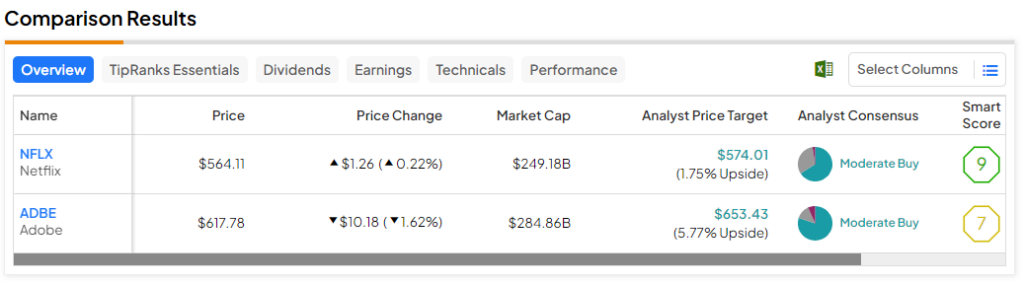

Analysts maintain a Moderate Buy rating for Netflix stock, comprising of 27 Buys, 13 Holds, and one Sell over the past three months. The average price target of $574.01 implies a modest 1.8% upside potential.

Adobe’s AI-Powered Renaissance

Adobe, another tech stalwart, has experienced a scintillating surge of nearly 70% over the past year, largely attributable to its generative artificial intelligence (AI) capabilities. Remarkably, Adobe has seamlessly integrated impressive AI technologies (e.g., Firefly and Sensei) into its renowned creative suite, which could potentially justify higher pricing for its users.

This relentless pursuit of added value, bolstered by the proliferation of AI, positions Adobe to attain previous heights. The unequivocal confidence in the company’s AI business resonates with industry experts, buoyed by the firm’s substantial and loyal user base. Upselling AI offerings to this installed user base is expected to be a seamless process for Adobe.

Beyond empowering creative individuals, Adobe’s commitment to fortifying AI ethics is highly commendable. The company has the capacity to implement suitable guardrails to mitigate (or prevent) AI product misuse, especially in light of recent AI-generated incidents. Following the abandonment of its Figma acquisition, Adobe is poised to emerge as a preeminent AI innovator and an advocate for AI safety and ethical usage.

The Price Target for ADBE Stock

Analysts accord Adobe stock a Moderate Buy rating, encompassing 24 Buys, four Holds, and two Sells over the past three months. The projected average price target of $653.43 indicates a potential 5.8% upside.

The Verdict

Amidst the array of high-growth companies that exhibit promising prospects, inclusion in the now six-entity Magnificent Seven is by no means guaranteed. Notwithstanding, both Netflix and Adobe epitomize enterprises worthy of this exclusive and coveted high-growth cohort. Analysts foresee a slightly greater upside for Adobe (5.8%) over the ensuing year.