Analyzed Scenarios with Interest Rates Variability

Interest rates wield a significant influence on companies, affecting their financial dynamics in multiple ways. The ebb and flow of interest rates can sway the expense and revenue structure, leading to divergent outcomes based on the industry’s nature. For instance, businesses like airplane leasing, reliant on hefty debt financing, witness a pronounced effect due to interest rate fluctuations. As companies secure expensive assets such as airplanes through borrowing and subsequently establish long-term lease agreements, the prevailing interest rates play a pivotal role in determining the magnitude of interest expense that reflects in their financial statements.

Wilis Lease Finance: Navigating the Interest Rate Terrain

At the close of the year 2023, Willis Lease Finance (WLFC), a company under the influence of interest rates, boasted a diverse portfolio comprising 337 engines, 12 aircraft, a marine vessel, as well as other leased components, catering to 74 lessees across 42 countries. With a substantial debt load of $1.95 billion as of June 30, 2024, of which $483.8 million is set to mature in 2025, the company finds itself in a delicate position. However, a potential silver lining looms in the form of a downward trajectory in interest rates. Such a scenario could enable the company to refinance its debt obligations at more favorable rates, resulting in a considerable reduction of interest expense and consequently, a boost to its earnings per share (EPS).

The recent acquisition of 15 environmentally friendly engines that operate at 17% lower fuel consumption levels could serve as an additional catalyst for Willis Lease Finance. This strategic move, costing $363.9 million, is poised to positively impact the company’s lease revenue trajectory.

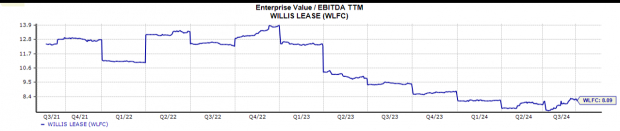

When evaluating the stock performance, the market is currently valuing Willis Lease Finance at 1.44 times its trailing 12-month price-to-book value. This metric stands against the backdrop of 1.7 times for the Zacks sub-industry, 4.01 times for the Zacks sector, and 8.52 times for the S&P 500 index, offering a comparative lens to assess the company’s valuation landscape over the past half-decade.

Investors Title Company: Navigating the Real Estate Landscape

On the revenue front, interest rate fluctuations have a palpable impact, particularly for industries heavily reliant on financial transactions, such as real estate dealings. Investors Title Company (ITIC), a key player in the domain of title insurance, finds itself at the intersection of market movements and interest rates. Drawing around 90% of its revenue from title insurance offerings that safeguard against potential losses arising from title defects, ITIC remains deeply entrenched in sectors sensitive to interest rate oscillations.

As a strategic play, Investors Title Company has directed its focus towards select residential real estate markets within the United States, with a prominent presence in lucrative regions like North Carolina, South Carolina, Texas, Georgia, and a recent foray into the burgeoning Florida market. This calculated regional concentration positions the company favorably in navigating market volatilities and capitalizing on the robust growth potential in the Sun belt region.

Furthermore, Investors Title Company exhibits financial resilience underscored by a robust balance sheet. Boasting $26.7 million in cash reserves coupled with minimal liabilities, the company maintains a strong financial footing, offering flexibility to seize growth opportunities, including potential acquisitions and expansions.

Given its operational model intricately tied to mortgage financings and housing price dynamics, Investors Title Company remains acutely attuned to interest rate movements. With market sentiments hinting at a slowdown in real estate transactions due to elevated mortgage rates dissuading both buyers and sellers, a gradual decline in interest rates might serve as a catalyst to revitalize the mortgage market activity, subsequently benefiting companies like ITIC.

Conclusion

Reflecting on the intricacies of small-cap companies such as Willis Lease Finance and Investors Title Company, it is evident that interest rates wield a profound impact on their operational and financial landscape. As these companies navigate the labyrinth of interest rate fluctuations, strategic maneuvers and prudent financial planning emerge as crucial pillars in steering through the challenging economic terrain. By seizing opportunities, mitigating risks, and leveraging market dynamics, small-cap entities can chart a course towards sustainable growth and enduring profitability in the ever-evolving financial landscape.