The financial world has witnessed a modern-day interpretation of the “Magnificent Seven” with leading companies like Microsoft, Apple, Nvidia, Alphabet, Amazon, Meta Platforms, and Tesla. While these giants continue to dominate the market, it’s Alphabet and Meta Platforms that stand out as prime investment opportunities.

The Evolution of AI in Business Operations

Both Alphabet and Meta Platforms have integrated artificial intelligence (AI) into their operations, amplifying their reach beyond conventional realms. Despite the AI buzz, these tech behemoths derive the majority of their revenue from the dynamic advertising sector rather than just innovative technologies.

In Q1, Alphabet raked in 77% of its revenue from ads, while Meta Platforms astonishingly earned 98% from advertisements. The emphasis on AI isn’t merely profit-centric; it serves as a strategic necessity to outperform peers by delivering cutting-edge tools to advertisers.

Alphabet and Meta Platforms have engineered generative AI models in-house, empowering advertisers to swiftly tailor their content, ensuring relevance and engagement. Such innovations, though revered, are essential for these industry leaders to maintain their competitive edge.

Resilient Business Growth Trajectories

Alphabet reported a 13% surge in ad revenue to $61.7 billion in Q1, with YouTube alone registering a remarkable 21% revenue spike to $8.1 billion. Despite the advanced stage of Alphabet’s advertising segment, YouTube’s exponential growth signifies untapped potential within the conglomerate.

Contrastingly, Meta Platforms exhibited dazzling growth by recording a 27% uptick in ad revenue, amounting to $35.6 billion in Q1. This robust performance was notably widespread across all global regions, hinting at Meta’s expanding influence and financial agility.

Wall Street analysts foresee Alphabet and Meta Platforms to sustain their growth momentum, projecting revenue escalations of 13% and 18%, respectively, this year. These foresights, coupled with consistent growth estimations, make them alluring ventures for prospective investors.

Valuation Insights: A Silver Lining for Investors

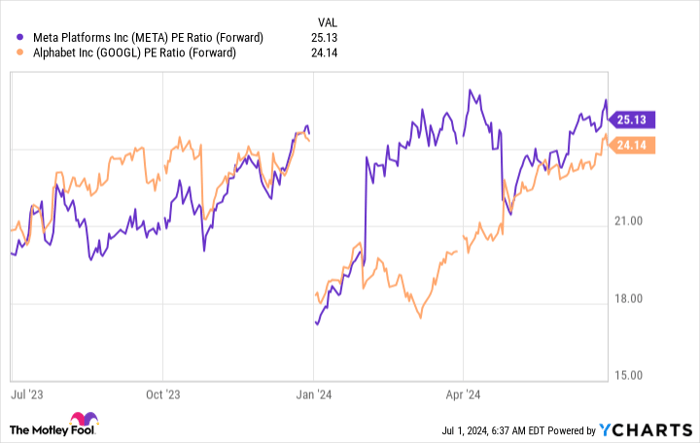

While Microsoft, Nvidia, Amazon, Apple, and Tesla boast lofty valuations, Alphabet and Meta Platforms offer a relatively modest entrance point for investors. With forward price-to-earnings ratios of 24 and 25, these stocks may carry slight premiums compared to the market average but are justified by their unmatched market position and operational prowess.

Their favorable valuations, alongside their stellar operational performances and projected growth trajectories, position Alphabet and Meta Platforms as standout options within the investment realm.

Considering the robust performances of these companies, anticipated growth, and reasonable valuations, Alphabet and Meta Platforms emerge as top contenders within the Magnificent Seven for savvy investors seeking long-term gains.

Is Investing in Alphabet The Right Move?

Prior to delving into an investment in Alphabet, a thorough contemplation is essential. The Motley Fool Stock Advisor team, renowned for identifying lucrative ventures, unveiled the 10 best stocks for investors, with Alphabet not making the cut. The picks deemed as potential “monsters” in terms of returns exclude Alphabet, reflecting the immense competition in the market.

Reflecting on past glories, like Nvidia’s staggering returns post-recommendation, Stock Advisor’s track record indicates substantial gains for diligent investors. With its unparalleled guidance and insightful analysis, Stock Advisor surpasses the S&P 500 returns, providing an enticing avenue for investors.

*Stock Advisor returns as of July 2, 2024