Roku’s Strategic Play for Long-Term Growth

Delving deep into the annals of tech history, we unearth Roku’s humble beginnings as a pioneering force in digital streaming device technology. Originally a partner to the streaming giant Netflix, Roku ventured to shift the video-streaming landscape from laptops to living rooms.

Back in the heyday of DVD mailers, Roku faced its fair share of challenges transitioning to the digital era. But much like the early days of Netflix when naysayers doubted its promise, Roku is undergoing a similar narrative today. Critics fret over declining sales growth and negative bottom-line figures, failing to see the bigger picture.

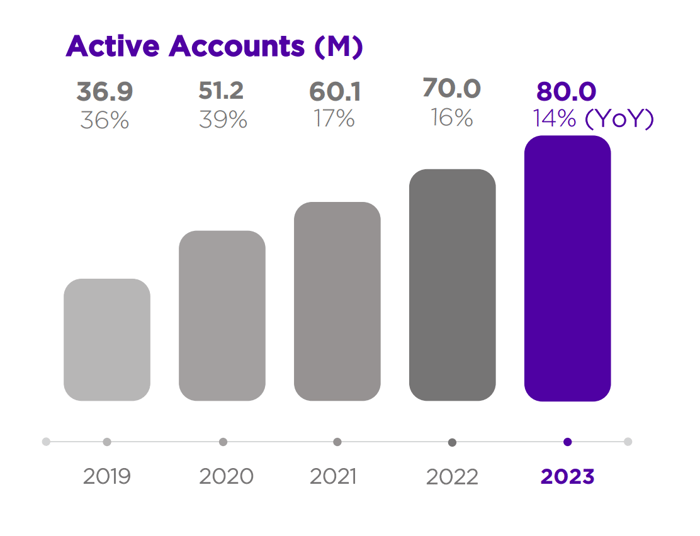

As the economic tides shifted, Roku charted its own course by holding prices steady amidst inflationary pressures. This strategic move to expand market share by underpricing streaming devices paid off handsomely, with active account numbers skyrocketing from 70 million to 80 million within a year.

Chart source: Roku’s Q4 2023 earnings report.

Despite facing the music of negative earnings, Roku’s cash profits are on an upward trajectory. The company’s knack for converting revenues into positive free cash flows underscores its sound financial footing, even in the face of volatile market conditions.

While the road ahead may seem clouded by short-term adversities like sluggish ad sales recovery in the media and entertainment industry, Roku’s value proposition remains intact. Trading at a discount from its previous peaks, Roku’s stock presents a compelling buying opportunity with a modest valuation of 2.7 times sales. It’s not a sprint but a marathon, and Roku continues to carve its name in the annals of tech history.

ROKU PS Ratio data by YCharts

The Evolution of AI-Powered Voice Controls with SoundHound AI

Shifting gears to the realm of AI innovation, SoundHound AI emerges as a disruptor in the voice control and audio analytics landscape. Catering to a diverse clientele ranging from automakers to drive-through restaurants, SoundHound AI revolutionizes user experiences through advanced artificial intelligence.

Leveraging deep learning systems honed over two decades of experience, SoundHound AI outshines competitors with unparalleled accuracy in voice recognition and command interpretation. The company’s software prowess extends to powering Netflix’s cutting-edge set-top box design, solidifying its position as a key player in the AI domain.

The Rising Tide of SoundHound AI: A Stealth Giant in the Making

Stealth Approach to Branding

SoundHound AI has maintained a low profile, allowing customers to integrate its technology under their own brand names, bypassing explicit SoundHound AI or Houndify branding. Users might unknowingly be interacting with the Houndify platform in various applications, from ChatGPT in Stellantis vehicles to voice-controlled systems at White Castle.

Rocketing Growth Potential

Despite its unassuming presence, SoundHound AI is poised for exponential growth. With revenues hitting $46 million in fiscal year 2023, the company boasts a robust backlog of unfilled orders and long-term contracts valued at a hefty $661 million—a figure that doubled just last year. This demonstrates the underlying momentum propelling SoundHound AI towards promising horizons.

Investment Landscape and Potential

Recent market buzz around SoundHound AI has lifted its stock price, fueled in part by a strategic investment from tech behemoth Nvidia. While the stock presently trades below its IPO price from 2021, the solid foundation of $661 million in long-term orders makes it a compelling proposition for investors, even if traditional valuation metrics raise eyebrows.

Potential Acquisition Target

The history of voice control and audio analysis companies being acquired is worth noting. Notable examples include Shazam’s acquisition by Apple in 2018 and Microsoft’s partnership with Nuance Communications in subsequent years. If tech giants seek a quick entry into the voice-control arena, SoundHound AI could spark a bidding war, given its advanced AI capabilities.

Underestimated Potential

Undervalued growth stocks like SoundHound AI present an appealing opportunity. When considering the vast addressable markets they target, parallels can be drawn to transformative companies like Amazon and Netflix—both of which captivated investors before their meteoric rises. While not a guaranteed success story, the growth trajectories of such companies are hard to ignore.

Analyst Insights and Investment Considerations

Investors evaluating SoundHound AI should weigh various factors. The Motley Fool Stock Advisor analysts recently highlighted the top 10 stocks for potential outsized returns, with SoundHound AI missing the cut. This underscores the importance of comprehensive research and portfolio diversification in navigating the dynamic landscape of growth stocks.

Disclosure: The author holds positions in Amazon, Netflix, Nvidia, Roku, and SoundHound AI. The Motley Fool has stake in and recommends Amazon, Apple, Microsoft, Netflix, Nvidia, Roku, and Stellantis. It also recommends specific options related to Microsoft. For full disclosure, refer to The Motley Fool’s policy.