Investing in companies adept at embracing and capitalizing on transformative trends can forge a path to immense wealth creation. While not every stock purchased may ascend to becoming a top-tier success, holding just a few colossal winners over the long term can yield extraordinary returns.

For those seeking to leverage impactful technology trends, consider investing in the following two pioneering companies as a potential gateway to significant financial victories.

Powering Ahead with Electric Vehicle Trend

Albemarle (NYSE: ALB), a premier lithium miner and a leading supplier of lithium for electric vehicle (EV) batteries, presents an alluring proposition for investors aiming to capitalize on the long-term growth of the EV sector. Despite enduring a stock slump, the company’s solid business performance indicates potential for remarkable long-term gains.

Although Albemarle’s stock has taken a beating due to declining lithium prices and heightened competition from Chinese counterparts, its recent sales figures showed a 10% year-over-year growth. The decline in its share price (53% from its 2022 peak) does not fully mirror the company’s business performance, with expectations of ending 2023 with sales up between 30% and 35% annually.

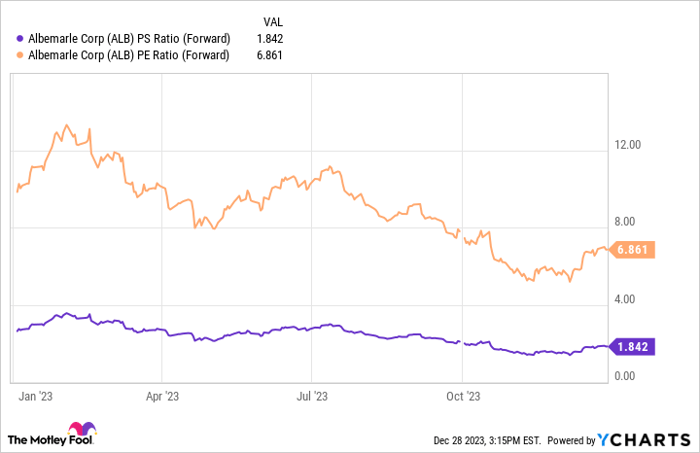

With a valuation of less than 1.9 times this year’s projected sales and less than 7 times expected earnings, Albemarle offers substantial growth potential at an attractive price point. While the slowdown in EV market growth is linked to macroeconomic pressures, the cyclical nature of the downturn in lithium prices suggests that Albemarle’s stock could deliver impressive returns in due course.

Seizing the Gains in Rising Cybersecurity Demand

The escalating importance of cybersecurity in reinforcing business resilience makes it an increasingly vital trend. With the mounting monetary and reputational fallout from security breaches, companies like CrowdStrike (NASDAQ: CRWD) are positioned as key players in mitigating cybersecurity risks. CrowdStrike’s cloud-based software, powered by artificial intelligence, not only averts cybersecurity breaches but also shields businesses from catastrophic setbacks, presenting a robust offering for investors.

Recorded revenue growth of 35% year over year in Q3, soaring non-GAAP net income, and substantial free cash flow, coupled with a strong financial position marked by a healthy cash reserve against zero debt, affirm the rock-solid fundamentals of CrowdStrike’s business. With the company poised to capture only a modest fraction of the forecasted $100 billion total addressable market in 2024, significant growth potential still awaits.

Driven by the expansion of its current services, introduction of new product offerings, potential partnerships, and untapped AI and cloud security opportunities, CrowdStrike envisions its total addressable market enlarging to $225 billion by 2028. With robust sales and profits growth and vast market opportunities on the horizon, CrowdStrike represents a compelling opportunity to tap into the burgeoning demand for high-performance cybersecurity services.