The surge in demand for artificial intelligence (AI) services has led numerous tech companies to shift their focus towards this burgeoning sector. The introduction of OpenAI’s ChatGPT has reignited excitement in AI and showcased its remarkable advancements over the years.

According to Grand View Research, the AI market is anticipated to witness a robust growth rate of 37% annually until 2030, potentially reaching a valuation of close to $2 trillion. AI is expected to revolutionize various industries, including consumer tech, cloud computing, autonomous vehicles, and machine learning.

Intel: Reigniting Innovation

In recent years, being an Intel investor has been quite challenging, with the company encountering several obstacles along the way. Despite once dominating over 80% of the central processing unit (CPU) market and serving as the primary chip supplier for Apple’s MacBook lineup, Intel’s complacency left it vulnerable to more innovative rivals.

Intel’s market share has dwindled to 63% due to competition from Advanced Micro Devices, and its partnership with Apple was severed in favor of in-house hardware designs. As a result, Intel’s stock has experienced a 35% decline over the past three years.

However, Intel seems to have rebounded from its setback, embarking on a strategic shift within its business model to drive efficiency and cost savings. Additionally, the company has made significant investments in AI, unveiling a range of AI chips to compete with industry leaders like Nvidia.

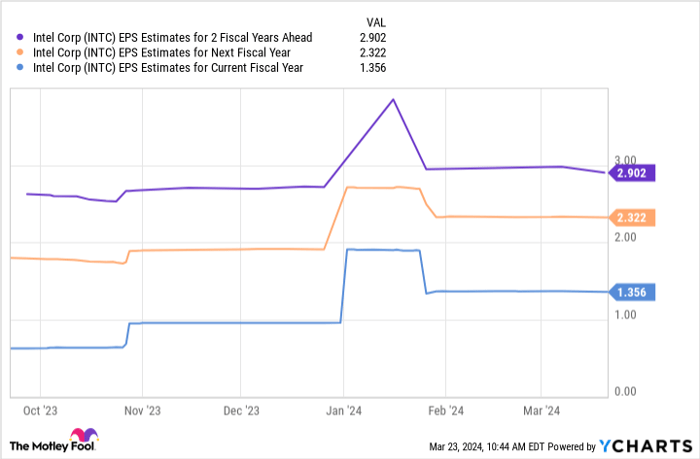

Despite facing stiff competition in the AI arena, Intel’s trajectory appears promising, with substantial earnings per share (EPS) estimates supporting its growth potential. Intel’s earnings projections suggest a substantial stock price increase, making it an attractive investment opportunity.

Advanced Micro Devices: Paving the Way in AI

Diversification is key when investing in AI, and Advanced Micro Devices (AMD) presents a compelling option for investors. With the second-largest market share in GPUs and a growing presence in AI, AMD has unveiled the MI300X AI GPU to challenge Nvidia’s dominance.

AMD’s recent quarterly earnings reflect positive momentum, with revenue growth and significant advancements in its AI-focused data center segment. The company has also expanded its market reach by developing AI-powered PCs, capitalizing on the projected surge in PC shipments driven by AI integration.

Analysts project a significant rise in AMD’s earnings over the next two fiscal years, potentially leading to a substantial increase in its stock price. With an expanding foothold in AI and a strong market position, AMD is poised for substantial growth in the coming years.

Investors eyeing opportunities in the AI sector may find Intel and Advanced Micro Devices to be promising options for potential growth and considerable returns in the long run.