The stock market is ablaze, burning with the fiery intensity of a thousand suns. The renowned S&P 500 index has surged an impressive 33% over the past year, igniting new highs like a pyrotechnic extravaganza.

In the midst of this financial inferno, the shares of Affirm Holdings (NASDAQ: AFRM) have ascended to unprecedented heights, soaring a staggering 300% in that same timeframe. Fueled by a potent combination of robust consumer spending in a surprisingly resilient economy and strategic alliances with top e-commerce behemoths, Affirm’s trajectory has been nothing short of meteoric.

The Explosive Rise of Buy Now, Pay Later

Affirm has unfurled an innovative financial tapestry through its buy now, pay later offering, simplifying the landscape of consumer transactions. Unlike the treacherous waters of credit cards with their tumultuous tides of high interest rates and penalizing late fees, BNPL provides a safe harbor for customers to parcel out payments without accruing interest—provided they adhere to the repayment terms.

With a bouquet of flexible payment solutions, Affirm caters to consumers with options like the “pay-in-4” plan, a brief, interest-free voyage allowing customers to divide purchases into four bi-weekly installments. Additionally, the company offers core loans, providing further flexibility through monthly installment loans, ranging from interest-bearing to enticing 0% annual percentage rate (APR) loans.

Affirm harvests revenues through two primary channels: earning fees from merchants each time a customer transacts using its product and deriving additional revenue when customers opt for its no-interest-rate product. The company also accrues interest from its interest-bearing loans, serving as a lucrative revenue stream especially in times of escalating interest rates.

The proliferation of the user-friendly BNPL products has been nothing short of astronomical over the years. Recent data from Adobe Analytics reveals that consumers funneled a staggering $75 billion through BNPL platforms in the past year alone, marking a 14% surge from the preceding year.

The Growing Burden of Consumer Debt

Despite the ominous shadows of an impending recession cast upon the economic landscape since early 2022, consumer spending has defied gravity, propelled by burgeoning credit card balances and the burgeoning array of BNPL options. Recent figures from the Federal Reserve Bank of New York illustrate that American consumers find themselves saddled with a daunting $1.13 trillion in credit card debt, a substantial 31% escalation over the last two years.

Image source: Getty Images.

The allure of Affirm’s 0% financing options shimmers brightly in the eye of the cost-conscious consumer amidst the high-interest-rate environment. Products like the popular pay-in-4 plan emerge as a compelling lifeboat for consumers seeking to navigate choppy waters by spreading out payments over several weeks.

Leveraging strategic alliances with e-commerce titans, such as Amazon and Shopify, Affirm has cemented its position in the buy now, pay later arena. These key partnerships have not only enhanced conversion rates but also bolstered Affirm’s revenue, which surged by a remarkable 43% to surpass $1 billion in the initial half of 2023. However, the company still wrestles with a net loss of $303 million during that period, an improvement from the previous year’s $593 million deficit.

An Imperative Metric to Monitor

Despite the awe-inspiring growth and strategic collaborations, prudent investors are wise to exercise caution as economic headwinds gather ominously on the horizon, particularly with the backdrop of soaring interest rates. The Federal Reserve’s recent decision to maintain the benchmark interest rate at 5.25% underscores the prevailing economic tension.

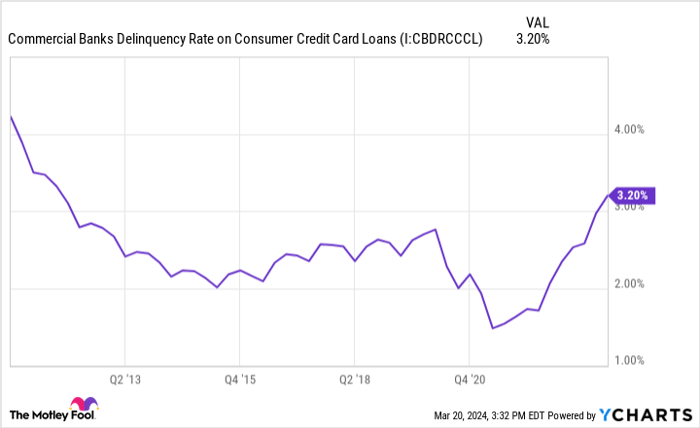

The unwavering demand for Affirm’s product mirrors a growing dependency on financing mechanisms to fuel consumer purchases, hinting at potential financial strain. Investors are advised to keep a vigilant watch over Affirm’s delinquency rates, currently hovering at 2.4% over the past two quarters, even as the company enforces stricter lending standards.

Commercial Banks Delinquency Rate on Consumer Credit Card Loans data by YCharts.

Exercise Caution in the Midst of Growth

Affirm’s growth story weaves a captivating narrative, yet the specter of looming losses coupled with escalating delinquencies cast a shadow of uncertainty over the company’s future trajectory. With net losses exceeding $2 billion in recent years, Affirm stands at a critical juncture where prudent caution must guide investor decisions, steering clear of potential pitfalls lurking amidst the glitz of growth and popularity.

Investors Advised to Tread Cautiously Amidst Rising Competition in BNPL Market

Consumer Preference Revealed

Recent findings from a consumer survey conducted by LendingTree have unveiled revealing insights into the Buy Now, Pay Later (BNPL) market. The data suggests that PayPal emerges as the frontrunner in the industry, capturing a sizable 55% of respondents who have utilized its services. Following closely behind are Klarna at 33% and Afterpay, owned by Block, at 29%. Affirm secures a 28% share, painting a competitive landscape in the BNPL arena.

Challenges for Affirm

Affirm finds itself navigating turbulent waters amidst a challenging operating environment. Factors contributing to its struggle include heightened interest rates, a surge in delinquencies, and stiff competition from rivals wielding larger market shares. These obstacles, coupled with the company’s mounting financial losses, raise concerns about the prudence of investing in Affirm stock at present.

Cautionary Investment Considerations

Prospective investors contemplating a stake in Affirm are urged to exercise caution and weigh their options thoughtfully. The Motley Fool Stock Advisor team recently highlighted a list of the 10 best stocks currently positioned for significant growth opportunities. Notably, Affirm did not make the cut, implying that alternative investment avenues may offer more promising returns in the foreseeable future.

The Stock Advisor service, renowned for its sound investment strategies, offers investors a comprehensive blueprint for success. With insights on portfolio construction, regular analyst updates, and two new stock recommendations monthly, the Stock Advisor service has remarkably outperformed the S&P 500 index since 2002, promising substantial value for subscribers.

As investors mull over their next move in the market, considering historical trends, expert advice, and prevailing market conditions is crucial in navigating the complex terrain of investment decisions.