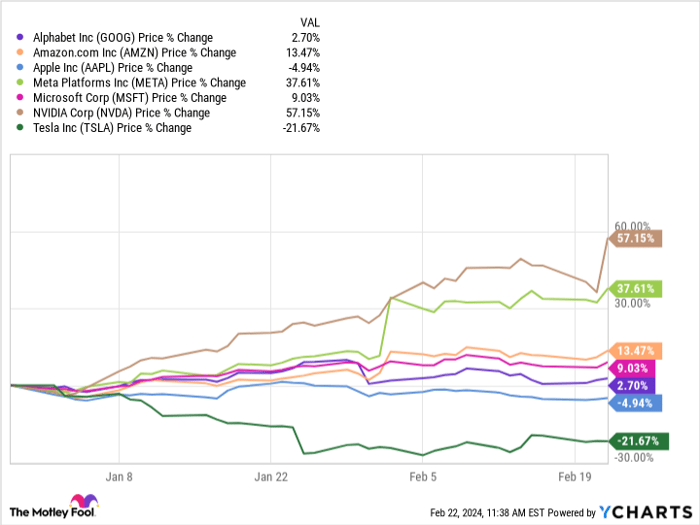

The stocks dubbed the “Magnificent Seven” have seen a tumultuous start to the year. This elite group encompasses top-tier tech companies that have displayed commendable performance over the last decade: Alphabet, Amazon, Apple (NASDAQ: AAPL), Meta Platforms, Microsoft, Nvidia, and Tesla.

Amidst this group, some stand out as overachievers, like Meta Platforms and Nvidia, while others are grappling with challenges. Apple falls into the latter category, with its stock witnessing a dip of nearly 5% year-to-date, marking one of the weakest performances in the cohort.

However, don’t be too quick to dismiss Apple. Let’s delve into why Apple remains a robust choice for long-term investors.

Apple’s Quarterly Performance Analysis

Following the release of Apple’s financial results for the first quarter of 2024, ending on December 30, 2023, the tech giant experienced a decline in its share value. While the earnings per share surged by 16% year over year to $2.18, net sales recorded a minimal growth of about 2% to $119.6 billion. The disappointing highlight revolved around its performance in a critical region, particularly China.

China posed a significant challenge for Apple as sales in the region plummeted by 13% year over year to $20.8 billion, constituting roughly 17.4% of Apple’s Q1 2024 revenue. Factors contributing to this decline included weakened iPhone sales and challenges with other devices. Yet, this setback is expected to be transient as smartphone sales in China faced headwinds due to economic factors for a substantial part of the previous year.

It’s essential to note that the comparative period had 13 weeks instead of the 14 weeks of the preceding fiscal year’s equivalent quarter. Additionally, inconsistencies in currency exchange rates negatively impacted Apple’s sales growth metrics in China. The economic sluggishness in China is temporary, and Apple is well-poised to capitalize on numerous growth opportunities in the long run.

Paving the Path for Growth

Apple’s revenue flagship, the iPhone category, saw a 6% surge in sales to $69.7 billion in Q1 2024. The standout performer besides iPhones was Apple’s services segment, with sales escalating by 11.3% year over year to $23.1 billion. Though services contribute around 19% of Apple’s revenue, this segment holds immense strategic significance for the company’s future.

With a massive installed base of 2.2 billion devices and remarkable customer allegiance, Apple is well-positioned to drive escalating, high-margin, recurring revenues from its diverse service offerings, spanning health apps, video and music streaming, and more.

Apple is strategically venturing into the realm of artificial intelligence (AI), although CEO Tim Cook has been discreet about divulging details, merely hinting at continued investments in upcoming technologies during the earnings call. While Apple may be trailing behind competitors like Microsoft and Alphabet in the lucrative AI market, underestimating Apple’s prowess would be imprudent.

With a substantial R&D budget fueled by $106.9 billion in free cash flow, Apple is well-equipped to spearhead innovations in AI, healthcare, fintech, and other sectors. Despite recent Chinese challenges, Apple’s plethora of growth avenues solidifies its longevity in the market.

Thus, Apple’s tribulations in China should not deter long-term investors. Instead, it presents an opportune moment to acquire Apple’s shares as it trails most of its Magnificent Seven counterparts year to date.