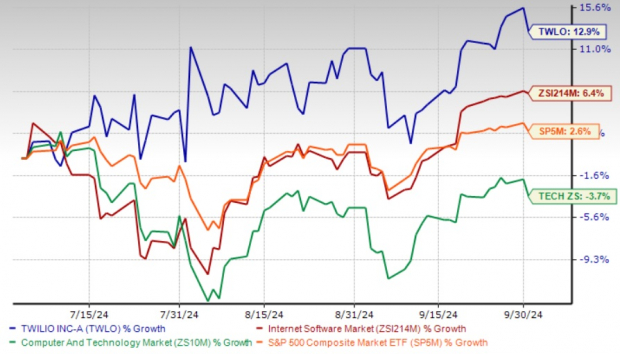

Twilio TWLO shares have shown brisk growth lately, outpacing both the Zacks Internet Software Industry and S&P 500 index. Investors’ exuberance stems from Twilio’s dominance in the customer engagement and communications sphere.

In a strategic move, Twilio has joined forces with OpenAI, integrating OpenAI’s speech-to-speech capabilities into its platform through OpenAI’s Realtime API. This collaboration aims to empower Twilio’s clientele with cutting-edge conversational AI functionalities, enhancing customer interactions and cutting operational expenses.

Twilio Three Month Performance

Image Source: Zacks Investment Research

Twilio Thrives on AI Momentum

Twilio’s unwavering emphasis on AI technology serves as a cornerstone for its growth trajectory. Having embedded AI-driven solutions in its customer engagement portfolio, Twilio arms its clients with automation and personalized interactions at scale.

Collaborations with tech giants like Amazon and Frame AI further bolster Twilio’s AI prowess. Products like Twilio Verify and Voice Intelligence are set to multiply as businesses seek AI-driven personalization for enhanced customer experiences.

In a forward-looking move, Twilio introduced Agent Copilot in 2024, merging AI with customer data to elevate customer engagement, unlocking new dimensions for its clientele.

Expansive Client Base Fuels TWLO’s Growth

Twilio’s API-centric approach has garnered a diverse clientele range, solidifying its market standing. With an arsenal of innovative products, Twilio boasts a client roster including the likes of Netflix, Airbnb, Lyft, Uber, and DoorDash.

Netflix utilizes Twilio’s services for account notifications and SMS messaging, while Airbnb leverages TWLO’s SMS features to streamline the rental process for travelers, exemplifying the company’s client-first approach.

Twilio’s relentless focus on innovation continues to attract new customers, underscoring its revenue growth potential for the coming years.

Guidance for Investors

Twilio’s pioneering presence in customer engagement, coupled with its AI-driven innovations, paints a promising future. Its developer-friendly platform and expansive API ecosystem have set it apart in the fiercely competitive domain of customer engagement and communications.

Given the strategic positioning and growth prospects, it seems only prudent for investors to consider acquiring this Zacks Rank #1 (Strong Buy) stock at the present juncture.

Conclusion

In summation, Twilio’s foray into the conversational AI space marks a significant leap towards redefining customer interactions and operational efficiencies. With a robust AI portfolio and an expanding client base, Twilio exemplifies resilience and innovation, painting a lucrative investment prospect for discerning investors.