Comparing Business Strategies

When it comes to Intel and Advanced Micro Devices (AMD), both players in the semiconductor industry, there are distinct differences in their business models. While Intel remains focused on manufacturing chips for PCs and laptops, with a significant portion of their revenue coming from a few key clients, AMD operates as a “fabless” chipmaker, targeting specific technological sectors like artificial intelligence and gaming.

Stock Performance Overview

The stock performance of Intel and AMD tells a tale of two different trajectories. While Intel has experienced a 32% decline year-to-date but a 5% increase over the past year, AMD has seen a remarkable 20% surge in 2024 so far and a 56% rise over the last year.

Analyzing Valuations

When looking at the price-to-earnings (P/E) ratios, the semiconductor industry’s average P/E of 64.1x stands out, notably higher than its three-year average. Intel, with a P/E of 36.5x and a forward P/E of 27.5x, seems relatively attractively valued at current levels.

Intel’s Position in the Market

Intel, with its recent struggles vis-à-vis AMD, seems to be in a transition phase. The company is adapting by outsourcing chip production to third-party manufacturers like Taiwan Semiconductor Manufacturing, a move that could potentially boost its competitiveness. However, uncertainties loom around its endeavors in AI and other evolving technologies, making it a speculative bet for investors.

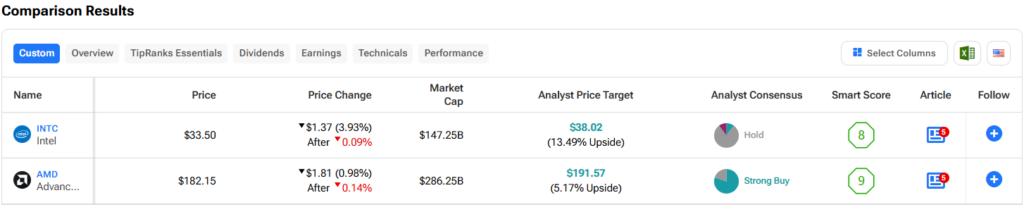

Intel’s stock has a Hold consensus rating, with analysts projecting a potential upside of 13.5% based on the average price target of $38.02.

AMD’s Market Dynamics

On the other hand, AMD has been commanding a premium over the industry, evident in its current P/E of 268x. However, its forward P/E of 45.9x paints a more reasonable picture and offers a discount compared to the sector’s valuation. Ahead of an upcoming earnings report, the company stands at a crucial juncture, where a favorable report could lead to a significant uptick in the stock price.

While AMD faces challenges in AI technologies when compared to peers like Nvidia, signs of progress are emerging. Investors are closely watching AMD’s financial performance, poised for a potential market-moving update following the earnings announcement.

Conclusion

In the dynamic landscape of the semiconductor industry, Intel and AMD present contrasting narratives. While Intel grapples with transformation and catching up in key technology segments, AMD navigates through market expectations and technological advancements. The stock performances of both companies reflect these ongoing narratives, offering investors distinct opportunities and risks as they determine their investment strategies in the semiconductor space.

The Battle of Titans: AMD vs. Nvidia

Advanced Micro Devices (AMD) and Nvidia, two leading giants in the semiconductor industry, are constantly at the forefront of innovation and competition. Recently, their financial performances have drawn stark contrasts, as seen in their latest earnings reports.

The Numbers Speak: AMD vs. Nvidia

In a battle of David and Goliath proportions, AMD reported a net income of $123 million following GAAP principles. While the revenue of AMD showed a modest 2% increase year-over-year, Nvidia soared with a remarkable 262% surge in revenue. To add fuel to the fire, Nvidia’s net income skyrocketed by 628% year-over-year, leaving AMD in its shadow.

Price Targets and Investor Sentiment

Despite the financial performance gap, Advanced Micro Devices still holds a Strong Buy consensus rating from analysts, with 28 Buy recommendations, seven Holds, and no Sells in the past three months. The average price target for AMD stock sits at $191.57, suggesting a potential upside of 5.3%.

Strategic View: Intel and AMD

In evaluating the investment landscape between Intel and AMD, AMD emerges as the more promising candidate for bullish prospects. Despite this, a cautious approach is advisable, waiting for a more opportune entry point into AMD stock. On the other hand, Intel could witness a positive trajectory if it delivers on analysts’ expectations. However, tangible evidence of transformative initiatives is crucial for Intel to tap into evolving technologies beyond traditional PCs and laptops, such as AI and other emerging markets.