Recent rumblings from Wall Street have sent shockwaves through the markets as Amazon (AMZN) sees a 3% dip in its stock value, courtesy of a rare recommendation revision by Wells Fargo (WFC) analyst Ken Gawrelski. The downgrade to a Hold rating and a lowered price target of $183 is a departure from the optimism that typically surrounds the tech giant. CNBC pundit Jim Cramer even likened the shift to a bolt from the blue.

In a sobering analysis, Gawrelski expressed skepticism about any near-term prospects for Amazon’s stock price, foreseeing mounting pressures as the calendar turns. With Walmart (WMT) upping its game in the digital retail space, the analyst raised concerns regarding escalating competition that could challenge Amazon’s e-commerce domination.

Storm Clouds Gather Over AMZN Stock

Gawrelski’s report points to a gathering storm for Amazon, citing various reasons for his caution. Among these are substantial investments in Project Kuiper, Amazon’s satellite internet venture, and a plateauing income stream from its online advertising arm. With these challenges on the horizon, Wells Fargo anticipates a sluggish margin growth trajectory for the tech behemoth.

This uncommon downgrade stands out in a landscape where most analysts are singing a different tune, with many adjusting their forecasts and price targets upwards for Amazon. On the very day that Wells Fargo took a more pessimistic stance, both JMP Securities and Morgan Stanley (MS) reiterated their Buy recommendations and upped their price projections for Amazon’s stock.

Despite the setback, Amazon stock has seen a 19% rise year-to-date, bolstered by a 41% surge over the past year. This dichotomy between market performance and analyst sentiment adds an intriguing layer to the narrative surrounding the tech giant’s future.

Navigating the Market Squall: Is Amazon Stock a Buy?

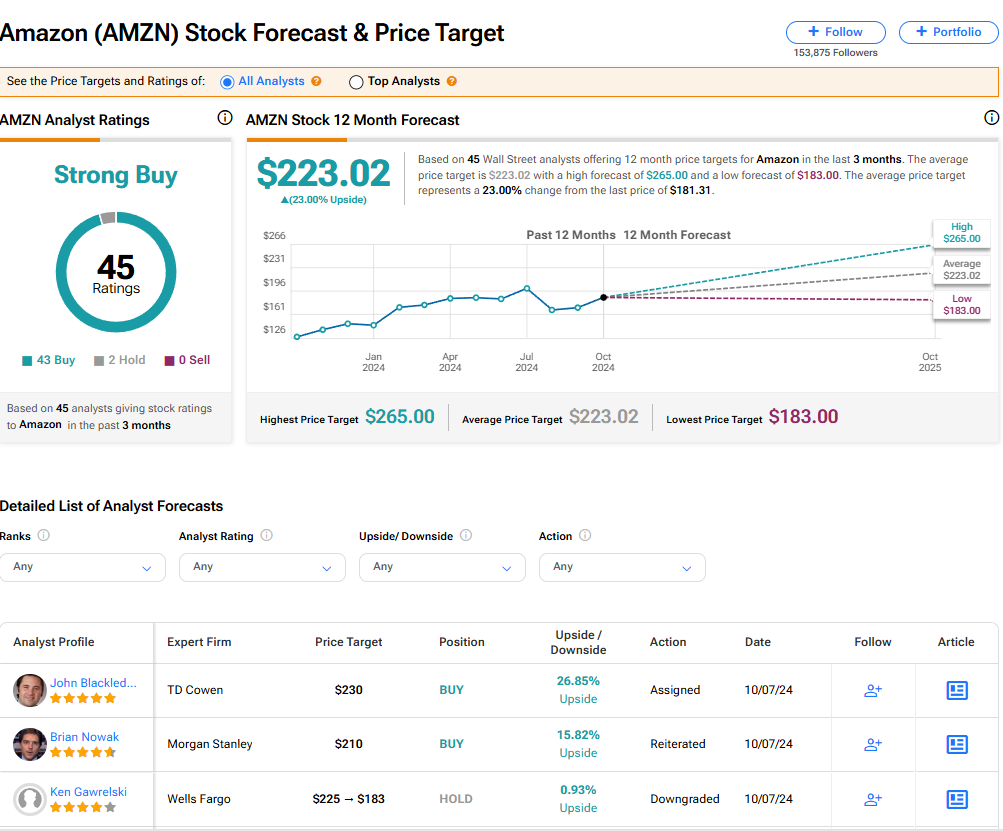

Wells Fargo’s contrarian stance places it in the minority when it comes to Amazon. The consensus among 45 Wall Street analysts remains resolutely bullish, with a Strong Buy rating underpinned by 43 Buy recommendations and two Holds over the last quarter. Notably, no Sell ratings have been issued for Amazon’s stock, painting a picture of unwavering market optimism.

Analysts foresee an average price target of $223.02, suggesting a potential 23% upside from current levels. This optimistic outlook contrasts sharply with Wells Fargo’s more cautious prognosis, underscoring the divergence of opinions within the financial sphere.